Is it possible for one person to complete thousands of trades per night? In fact, with artificial intelligence in stock trading, you can do even more! Every day innovative use cases of AI hit the headlines, so no wonder this disruptive technology has entered the stock market world. And since its pattern recognition algorithms greatly extend trading opportunities, in 2024, more traders and investors will switch to AI-powered tools.

However, artificial intelligence in the stock market brings up a lot of questions, so below, you'll find the answers to the most frequent ones!

Is it possible for one person to complete thousands of trades per night? In fact, with artificial intelligence in stock trading, you can do even more! Every day innovative use cases of AI hit the headlines, so no wonder this disruptive technology has entered the stock market world. And since its pattern recognition algorithms greatly extend trading opportunities, in 2024, more traders and investors will switch to AI-powered tools.

Contents

What Is AI Trading?

Algorithmic trading and automated trading are the first notions that cross the minds of experienced market participants when they think of AI in stock trading. Although these types of trading have much in common, there is a difference between them. Also, you've probably come across quantitative trading and high-frequency trading, so let's sort everything out.

If you choose a market strategy that involves advanced mathematical methods and statistic analysis, it's quantitative trading. This strategy lacks qualitative analysis of subjective factors (like brand strength or management expertise) and requires manual position opening.

When you employ technical analysis and algorithms based on preset rules to divide a huge trade bid into small parts, it means we deal with algorithmic trading (algo-trading). And since algorithmic systems automatically compare the quotations, no wonder both hedge funds and retail traders resort to them.

High-frequency trading (HFT) is merely a type of algorithmic trading characterized by high turnover rates and sophisticated financial algorithms. Leveraging this strategy enables large investment companies to execute trades at high speed and recurrence.

If you completely automate the quantitative strategy and add portfolio management and computational algorithms built on previous financial data, you'll get automated trading (or AI trading). And in this case, it's just a computer (not a trader or investor) that will buy or sell assets in compliance with preset parameters. And you can exercise this hands-off approach thanks to artificial intelligence and machine learning technology.

Each of the above-mentioned trading models does unlock multiple benefits. Still, to enjoy them to the fullest, don't neglect special training courses for traders. Yes, AI trading will allow you to take advantage of the stock market in the most streamlined manner, but to choose the most reliable stocks for trading and increase the revenue, you'll need to conduct a basic fundament analysis beforehand.

What Are the Pros and Cons of AI Trading?

Now, that you know what AI trading is and how it differs from other types of trading strategies, let's focus on its benefits and disadvantages.

Pros

- the accelerated process of opening and closing stock positions

- the ability to submit numerous orders in a short time

- sticking to the rules (with emotions removed) enhances decision-making

- backtesting of historical data helps to mitigate future risks and save money

- automation provides discipline so your trading plan will be precisely followed

- quick response to real-time market changes and price hikes prevents losses

- accelerated and automated generation of the positions once they were entered

- optimized diversification allows spreading risks over several financial instruments

Cons

- technical errors and connectivity issues can negatively affect trading performance

- the AI trading platform still requires constant human control

- trading strategies built on backtesting may fail in live trading

How Does AI Trading Work?

While trading, it's crucial to identify patterns (price fluctuations) and market irregularities in time. Since this process can be rather challenging and monotonous, its automation by AI-powered software becomes a perfect solution.

To better understand the intricacies of its functioning, let's analyze the following example.

Let's say you need to acquire 50 Microsoft shares automatically when its 30-day moving average goes above the 120-day average. To get this result, you need to choose a reliable AI trading system, set your requirements (timing, quantity, price of opening and closure), and launch the algorithm. And while it processes financial data and selects the data patterns in compliance with the predefined conditions, don't forget to monitor its work.

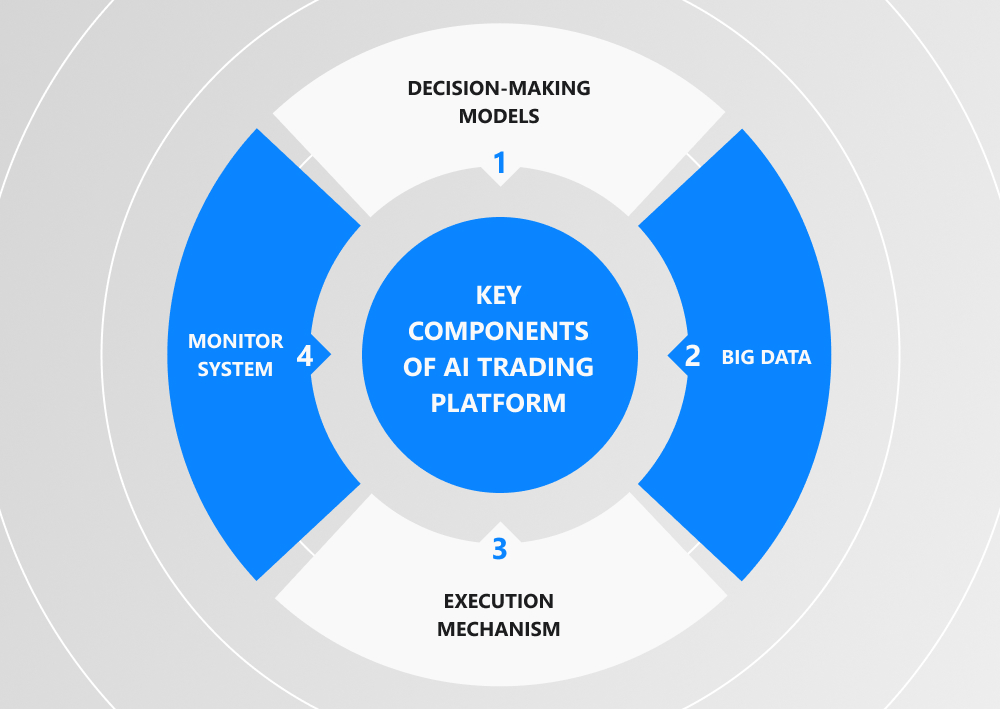

And this is what we've got on the surface. But if we go deep into technical issues and analyze the AI trading platform, we'll see that it consists of four major components that carry out specific functions.

Thus, decision-making models create interpretations of financial markets, the big data component calculates price fluctuations and looks for their reasons, the execution mechanism is responsible for process acceleration, and the monitor system helps the decision-making models to adjust to changing market environments. Taken altogether, these components make the platform work smoothly.

Is AI Trading Legal?

Yes, both algorithmic and AI-trading are legal. By the way, have you known that 52% of the US financial services firms already employ deep learning for developing innovative trading and investment strategies?

So, we should consider the use of algorithms and automation in the investment industry as an inevitable step of the global digitalization process, because these technologies make the work of traders and investors safer and easier.

Who Can Use AI to Trade Assets?

With trading software empowered by deep learning and automated pattern-matching technology, any market participant can gain the upper hand in the volatile investment market. Still, keep in mind that leveraging artificial intelligence does not guarantee 100% profit. It's just the technology that analyzes data sets, and sometimes it makes mistakes.

So, who can benefit from using AI tools? Both retail traders and large investment companies have access to AI-driven solutions and can employ them to trade assets.

Which AI Tools to Use For Trading?

For AI trading, you can choose either an off-the-shelf solution or a self-built platform. The second option will give you more flexibility and a deep understanding of the functionality, but a ready-made system also opens up certain opportunities.

So, let's discuss what AI platforms you can employ to enhance your trading performance.

Trade Ideas

Its powerful research tools use artificial intelligence to scan stocks and assess the outcomes of various trading scenarios. Trade Ideas is a subscription-based platform that doesn't offer free trials. Its Standard plan involves a chart-based virtual assistant and price alerts, and the Premium option (Holly the A.I.) provides risk and trading cycle management.

Tickeron

This stock trading platform created for retail traders and investors offers a wide range of AI-driven services, either charge-based or free. It's also presented in the form of a mobile app, which enhances the user experience. You can find daily signals, a pattern search engine, and trend prediction tools among its valuable features.

BlackBox Stocks

With AI tools embedded into this platform, traders can efficiently deal with stocks and options. The features like market scanners, volatility indicators, and real-time quotes facilitate the trading process and enhance decision-making, which gives platform users a competitive edge. Also, the platform offers free classes and live webinars for all subscribers.

Will AI Replace Stock Traders?

Who is gonna win in the competitive investment field: humans or machines? This question has been bothering many users since artificial intelligence entered the stock market. Thus, on the one hand, we have a powerful technology that can boast of high efficiency, accuracy, and speed. On the other hand, we see a human brain with its flexibility, vitality, and emotions. And sometimes, as we all know, emotions do matter.

So, it seems that the future of successful trading lies in the cooperation (not the competition) of sophisticated AI algorithms and efficient human management.

Is It Possible to Use GenAI in Stock Trading?

Generative AI is one of the killing buzzwords nowadays. Unlike traditional AI with the automation function at its core, GenAI is aimed at new content generation based on vast amounts of training data. Therefore, it may come in handy in fundamental analysis, i.e., it may help you handpick the companies for further stock trading by quickly providing such information as EBITDA margin, ROE, ROA, P/B, P/E, and others.

Top 5 AI Stocks

Since we've plunged into the investment industry, as a bonus, let's discuss some ideas trade participants can make use of.

Have you heard that 80% of companies plan to automate their services by 2025? It means the AI stock market will also significantly grow. So, let's shortlist the companies that offer AI-driven apps and services and are interesting for long-term investments.

- Amazon (AMZN)

- IBM (IBM)

- Microsoft (MSFT)

- Nvidia (NVDA)

- Nice Ltd. (NICE)

In today's ever-changing world, people seek new ways to save and augment their assets. So, investing in the stocks of reliable companies may become a possible solution. Still, the above-mentioned information is not a ready-to-use investment strategy, it's just a piece of advice that requires proper fundamental analysis. Keep this in mind and don't hesitate to employ AI trading tools.

In case we’ve missed some details, or you want to find out how artificial intelligence can enhance your business, please, contact our specialists. Qulix is an expert in AI-powered solutions, ready to offer you excellent customer service.

Contacts

Feel free to get in touch with us! Use this contact form for an ASAP response.

Call us at +44 151 528 8015

E-mail us at request@qulix.com