A constantly growing competition and the need to keep pace with technological trends force banks to have an open mind regarding digital innovations.

The banking industry has always tended to be conservative. Banks are usually very careful with any kinds of experimentations. At the same time, they can’t ignore them completely.

The Blockchain revolution

written by:

Anton Rykov

Product Manager, Qulix Systems

A constantly growing competition and the need to keep pace with technological trends force banks to have an open mind regarding digital innovations.

The banking industry has always tended to be conservative. Banks are usually very careful with any kinds of experimentations. At the same time, they can’t ignore them completely.

The Blockchain revolution

A lot has been said about Blockchain. Mainly it relates to the openness of the technology and crypto-currencies based on it. But it’s not widely known that Blockchain can be also implemented for classic banking. For example, it can be used to create a transparent system for payments tracking.

In fact, the usage opportunities of Blockchain technology in the financial industry are enormous. As soon as a customer is identified, it is possible to view the history of payments in real-time and, thus, judge the credibility when, let's say, making decisions about loans. Besides, the technology is also perfectly suitable for investment banks obligated to perform their own ‘Know Your Customer’ checks.

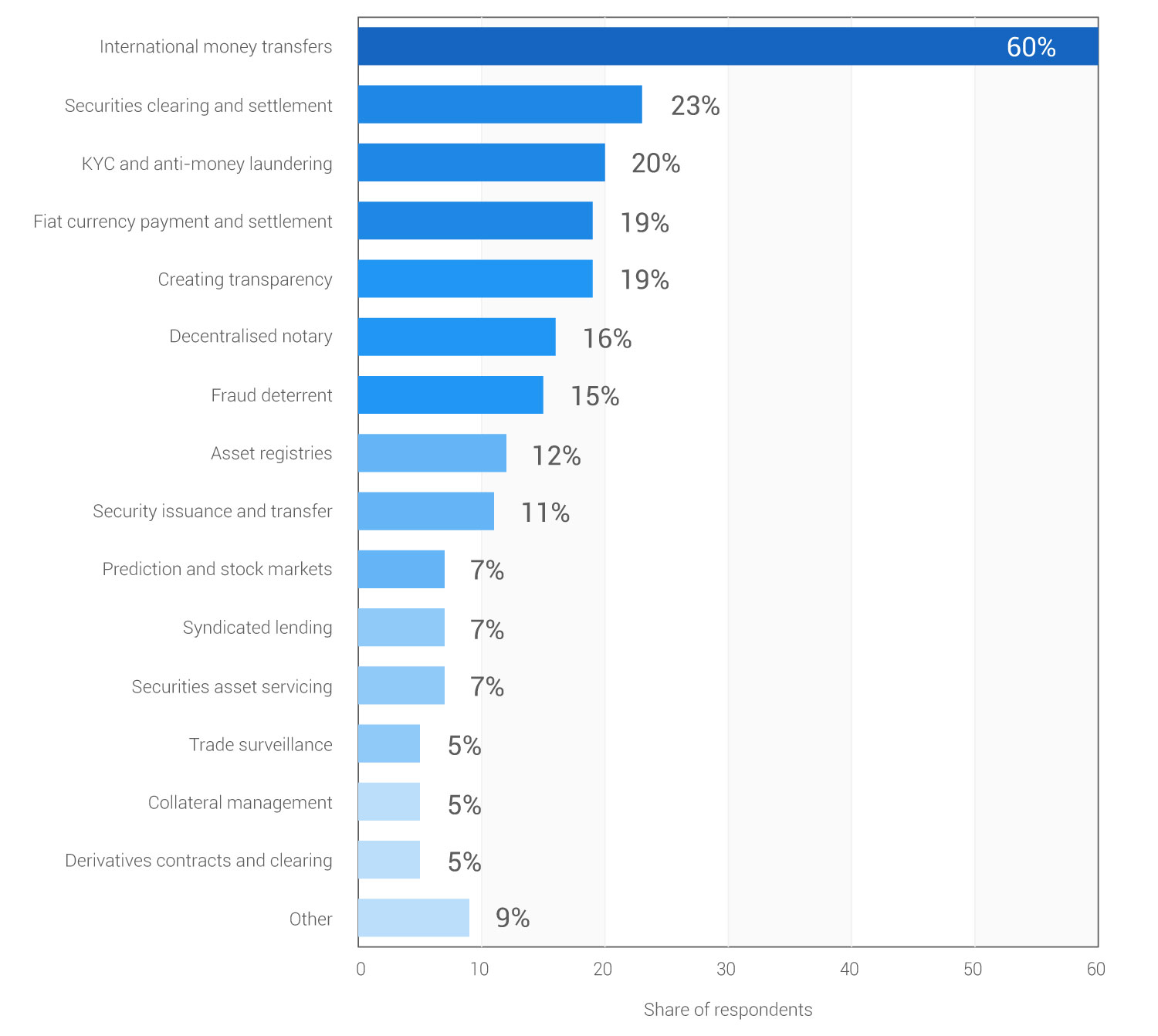

According to statistics in 2016, 60 percent of the surveyed financial companies worldwide were planning to use Blockchain for international money transfers. Security clearing and settlement were named by 23 percent, while 20 percent of respondents chose ‘Know Your Customer’ (KYC) and anti-money laundering.

Blockchain technology usage opportunities among financial institutions worldwide in 2016:

Source: www.statista.com

How does a Blockchain work?

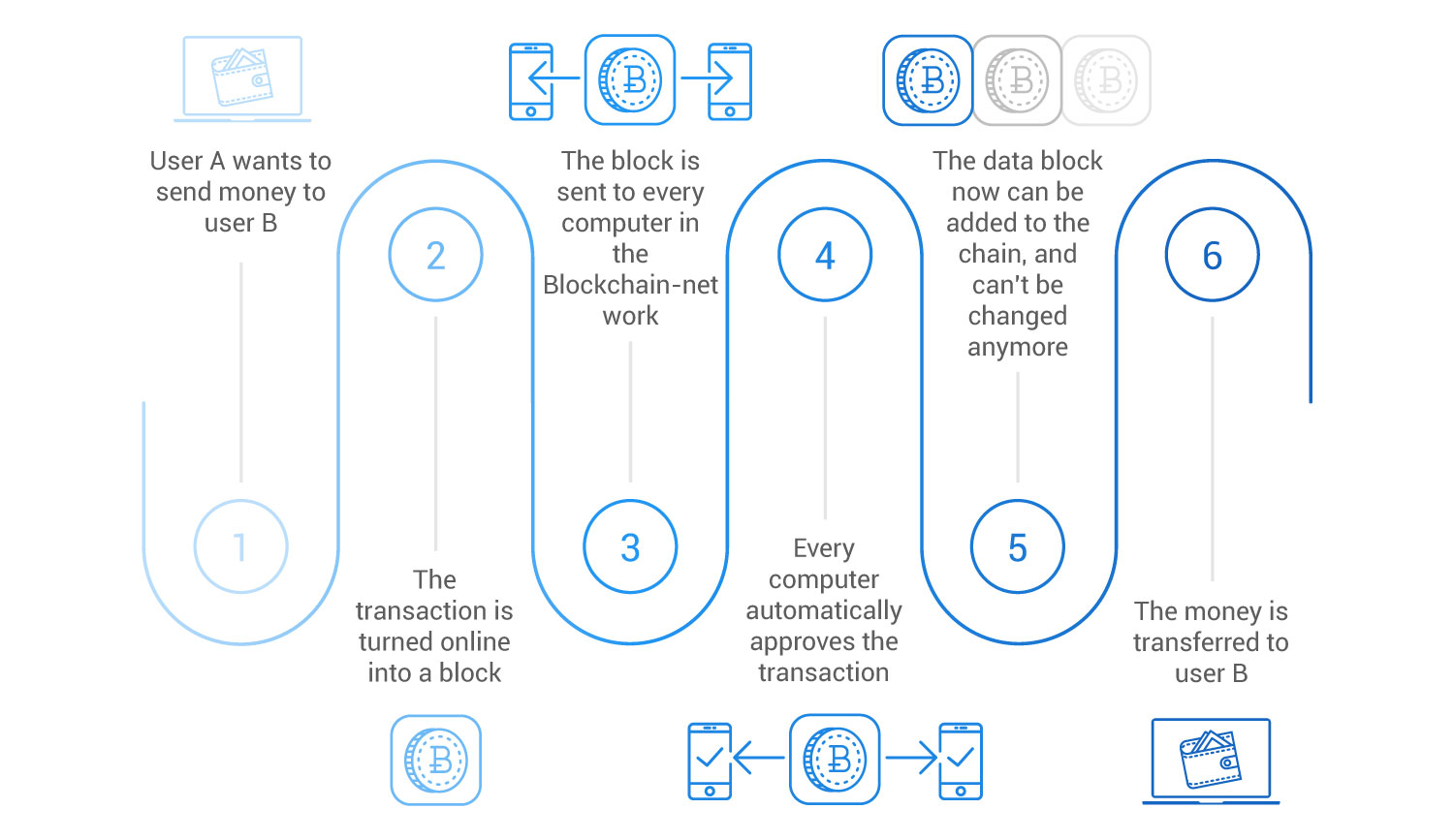

Currently, we use a financial intermediary, e.g. a bank, to perform money transactions. In contrast, Blockchain enables consumers and providers to communicate directly with each other, eliminating the need for a third party.

Due to the encryption of data traffic, Blockchain provides a decentralized transaction database that is accessible for all network users.

This network represents a chain of computers that have to approve every single transaction before it is confirmed and recognized.

In other words, it is a kind of electronic account book that consists of transactions in the form of data blocks.

Challenges facing Blockchain

Despite the great potential of Blockchain for the financial industry, the technology is still in its infancy, it lacks a standard platform. A widespread Blockchain usage requires technical industry standards ensuring compatibility between different Blockchain platforms.

The integration of Blockchain technology with the existing IT infrastructure represents a further challenge. The IoT will significantly expand the attack surface for the Internet. In fact, the IT security plays an essential role in the Blockchain world.

In the financial industry, supervisory authorities still prefer a central contact that can be called to account when something unexpected happens: e.g., software bugs or hacker attacks.

Moreover, there are questions to be clarified regarding compliance as well as fraud detection and prevention (incl. money laundering and legal framework for crypto-currencies).

Finally, there is a need for clear data privacy regulations and the question on how to concurrently ensure a transparency across transactions.

Find out more about Qulix Banking and Finance App Development

Conclusion

There's a lot of hype surrounding the Blockchain technology. However, there are some ambiguities concerning the way it can be used most effectively.

Without any doubt, Blockchain can help to automate particular features in simple transaction-related application cases.

Nevertheless, there is a range of questions to be solved before the technology can be used with tangible benefits.

Contacts

Feel free to get in touch with us! Use this contact form for an ASAP response.

Call us at +44 151 528 8015

E-mail us at request@qulix.com