The sales and marketing industries have been using cloud computing technology for a while now. Still, it's only recently that financial institutions took a risk and moved their core operations to the cloud-based banking platform. Banks have managed to succeed in this digital transformation despite all fears and prejudices as it allowed them to reduce costs, optimize routine operations, and create a positive customer experience. And this is just a tiny part of all the benefits.

So, what is the next generation's core banking platform, and how can it enhance your financial solutions? Let's find out together!

written by:

Alexey Krutikov

PMP, Project Manager,

Qulix Systems

The sales and marketing industries have been using cloud computing technology for a while now. Still, it's only recently that financial institutions took a risk and moved their core operations to the cloud-based banking platform. Banks have managed to succeed in this digital transformation despite all fears and prejudices as it allowed them to reduce costs, optimize routine operations, and create a positive customer experience. And this is just a tiny part of all the benefits.

So, what is the next generation's core banking platform, and how can it enhance your financial solutions? Let's find out together!

Contents

Basics of the Core Banking System

Before we plunge into the specifics of cloud-based computing, let's briefly analyze the general structure of core banking.

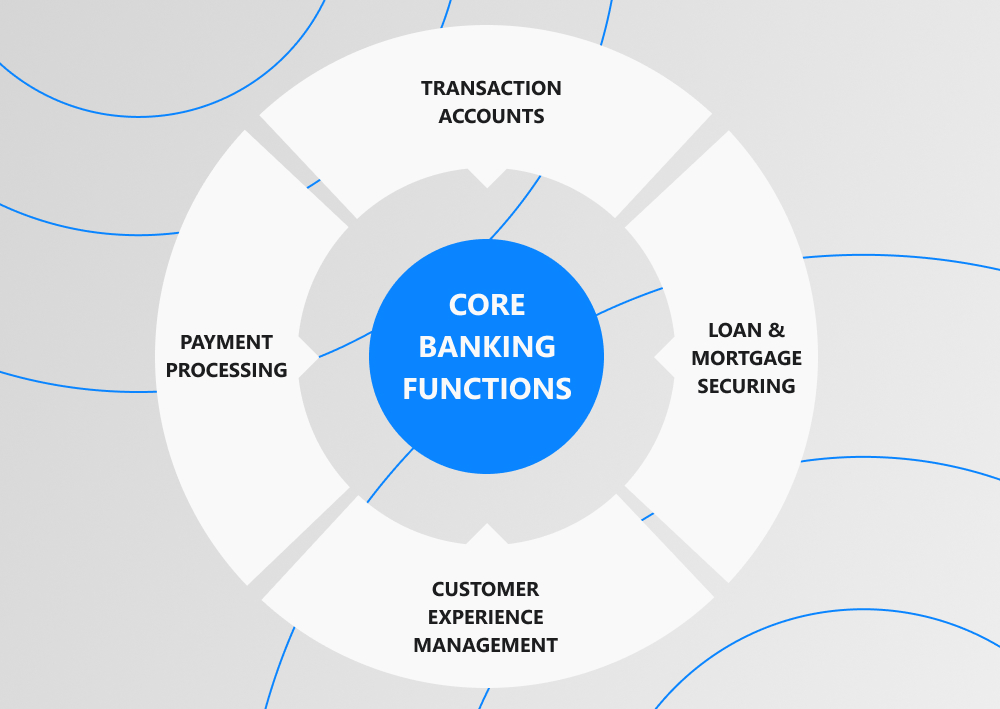

So, the core banking system (CBS) is a network banking service that unites major bank branches and allows customers to carry out various transactions via their bank accounts. By the way, the notion 'core' here stands for Centralized Online Real-time Environment. Thanks to banking software, transaction data can be stored, processed, and reflected in financial records. Also, keep in mind that it’s retail clients who are regular customers in the frame of core banking.

In general, core banking includes transactions, payment processing, loan and mortgage securing, and customer experience management. These functions are implemented via Internet and mobile banking, ATMs, and self-service terminals.

On-premises Vs. Cloud-Based Computing

For years banks and financial institutions have been using traditional on-premises software. But in order to improve digital banking, various organizations ventured to choose a cloud system for financial services management. What made them take this risk? To answer this question, let's compare on-premises and cloud-based computing.

Scalability

If the demand for your services increases, you should be able to extend your resources quickly and seamlessly. And in case downscaling is required, it’s essential to reduce the resources on time to escape overpayment.

On-premises computing involves fewer options and higher infrastructure and maintenance costs, making it much more challenging to scale up or down. But if you choose cloud-native computing, your costs will depend only on the cloud capacity, so the process of scaling up and down will be much faster and easier.

Server Storage

Servers of on-premises systems require a lot of space and effort, which causes some maintenance hassles. On the contrary, using cloud technology allows companies to retain more space and operate more effectively because, in cloud-based core banking, it's cloud service providers who manage the servers.

Data Security and Recovery

If a company has on-premises computing equipment in place, it usually applies traditional IT security measures which provide less data security. For the same reason, in case of data loss, the chances of recovering this data are very low.

Cloud-based solutions, on the other hand, are considered much safer. What's more, the system offers robust technologies that ensure rapid data recovery.

Maintenance

In case you opt for on-premises setups, you'll need to hire an additional team to maintain hardware and software. This step involves an uptick in costs. With cloud systems, on the contrary, a service provider deals with maintenance, making them a cost-efficient option.

Cloud Computing Models: What Are They?

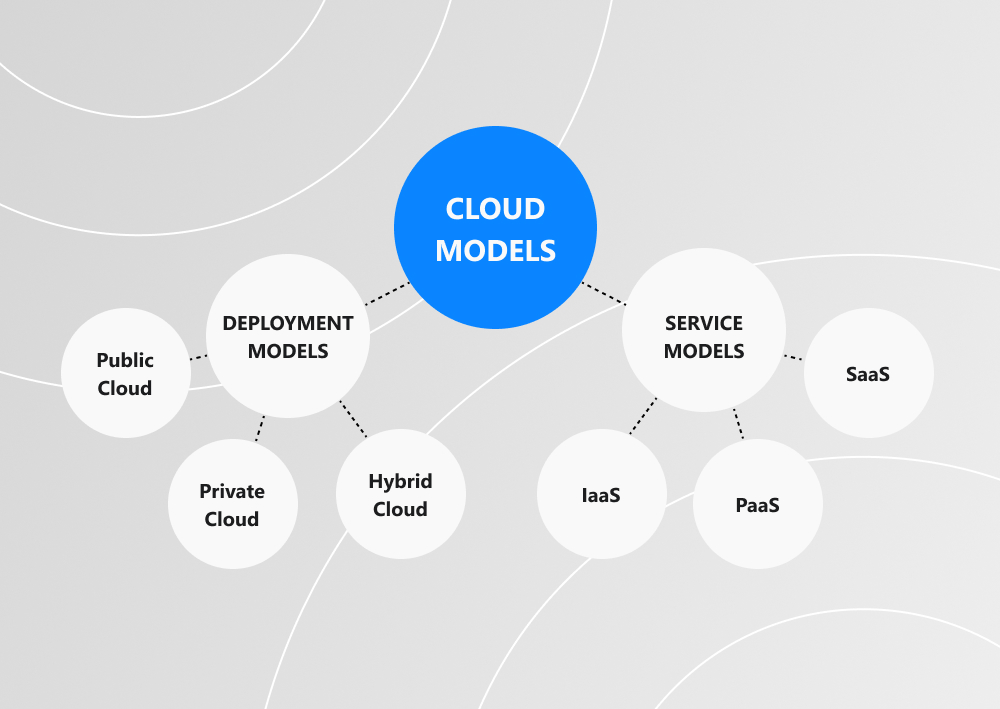

Cloud computing is represented by various models that are divided into two groups. Their general purpose consists in finding the balance between user-friendliness and security, further reducing maintenance costs. Each financial organization can choose a perfect solution for its core banking system, so below, you'll find the most relevant characteristics of these models.

Deployment Model

This category of computing models includes hybrid cloud, private cloud, and public cloud. Let's quickly analyze them!

In banking, the use of public clouds allows sharing infrastructure across various bank branches. The Covid-19 pandemic has pushed forward this model in the financial industry. The public cloud has its pros and cons, but choosing the right banking software vendor can undoubtedly bring many benefits for the organization.

Using the private banking cloud lets you exercise total control over digital access and security in your core banking system. However, private clouds significantly lag behind public banking clouds in scalability and storage space.

And finally, let's have a look at hybrid clouds. Actually, they are a mixture of public and private cloud functionalities. The hybrid cloud offers banks more flexibility and cost-effectiveness. In fact, about 90% of enterprises plan to embed the hybrid cloud model by 2022.

Service Model

There are three major models belonging to this category: SaaS, PaaS, and IaaS. Below you'll find their key features.

In the IaaS (Infrastructure-as-a-Service) model, customers get access to basic computing infrastructure as it's always available thanks to hardware resources. By the way, Amazon Web Services offers this approach. Although this model provides certain benefits, the IaaS model is not so popular among financial institutions.

The PaaS (Platform-as-a-Service) model is a perfect choice for customized applications. The brightest example of such a platform is Microsoft Azure. In the banking industry, this feature enhances customer experience and facilitates scalability. It is possible because developers have quick access to numerous tools and innovations, which reduces the time for application management.

The most widely used model in banking and finance is definitely SaaS (Software-as-a-Service). This option allows you to use banking software without downloading it. Let's take Internet banking for example. To complete transactions, you don't have to download the application; you can do it via browser.

Why Switch to the Next Generation Core Banking System

So, on the one hand, we have a core banking system that helps to provide financial services efficiently. On the other hand, there is cloud-native computing which facilitates routine operations and enhances the company’s capabilities. By combining these two technologies, we get a cloud-based core banking platform.

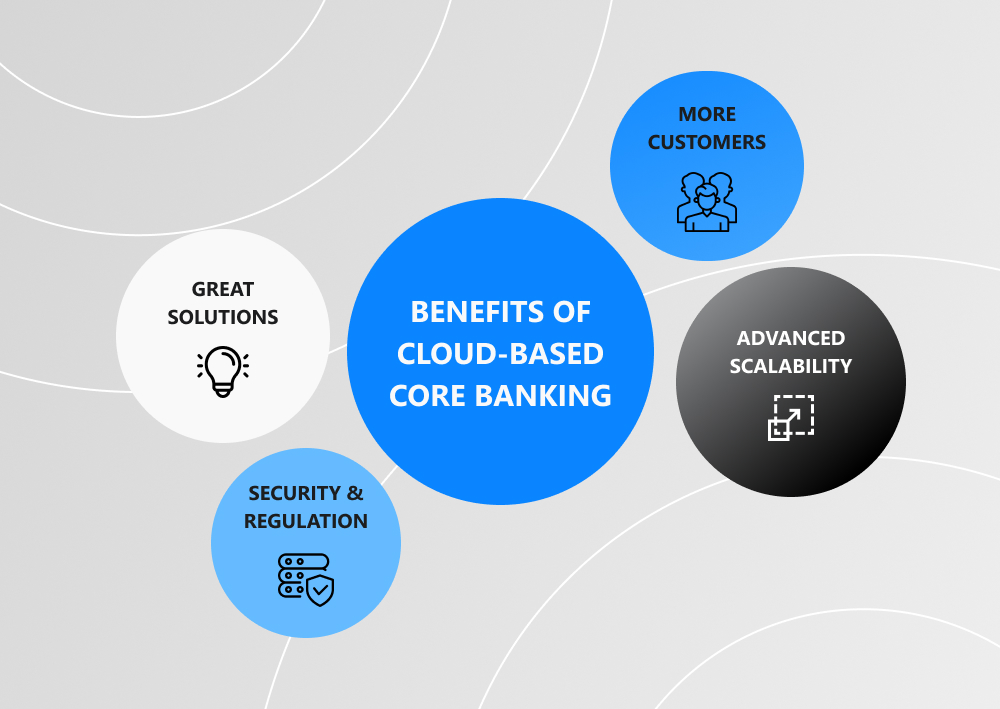

But what are the benefits of the core banking system of the next generation?

Great Solutions

First of all, such digital transformation helps to improve core banking solutions. By mitigating human reliability in financial operations, you can reduce the number of errors and achieve better results. Secondly, cloud analytics is useful when it comes to enhancing the process of making strategic decisions. And, last but not least, such solutions are cost-effective, because a cloud-based core banking platform requires fewer specialists, which reduces administrative costs.

More Customers

Cloud-based digital banking helps to address customer expectations most efficiently. When making transactions, clients generate a lot of data that gives insights into their creditworthiness and payment behavior. Later, this cloud-stored data can be analyzed to understand changing customer demands and enhance their future experience.

Security & Regulation

When the question of security level and regulatory compliance comes up, advanced financial companies choose cloud-based core banking systems. Cloud technology is rather effective in risk management, fraud detection, and customer data safeguarding. So, as long as banks see the ability to identify security breaches as an absolute priority, cloud computing will be in high demand.

Advanced Scalability

Staying viable is a crucial goal for any enterprise. Banks are no exception as they should be able to accept challenges and scale up efficiently to retain clients and reduce maintenance costs. So, by moving core banking systems to the cloud, banks can quickly achieve this goal and enhance their financial services.

Summing Up

In 2021 banks keep struggling to meet clients' expectations by enhancing primary digital operations. At this point, cloud banking comes in handy as it provides an excellent opportunity to push forward your products and services.

If your company is ready for this challenge, all that is left is finding a reliable vendor. The software giants like Temenos and Google Cloud will be a great option, but smaller IT vendors can also offer you quality digital products at a competitive price.

If you're planning to move your core banking system to the cloud, Qulix Systems is ready to help you out. Our team is quite experienced in the field of cloud development, so we are here to save your time, effort, and money. If you have any doubts and questions, please contact our specialists.

Contacts

Feel free to get in touch with us! Use this contact form for an ASAP response.

Call us at +44 151 528 8015

E-mail us at request@qulix.com