Ever wondered who are challengers and incumbent banks? If you want to identify them, just check how they engage with the clients and what digital tools they employ. The latter are physical branches that reluctantly embed innovative solutions into their business model and fail to provide a seamless customer experience. The challengers, on the other hand, leverage digital sales channels and put the clients at the top of their decisions. So, what are digital sales in banking, and are they worth trying?

Since this issue is closely connected with the overall digital transformation process, let's briefly analyze how brick-and-mortar bank branches overcome this challenge.

written by:

Alexander Arabey

Director of Business Development

Contents

Financial Institutions vs. Digital Transformation

Banks are institutions with a long history. When it came to safekeeping, loans, and investments, people always turned to the nearest bank branches. But let's face the truth: most customers hate banks, and hardly anyone feels enthusiastic about getting outside and standing in a long queue to part with the savings in such a dull and boring way. Nowadays, people prefer comfort, simplicity, and transparency; that's why to meet their demands, a bank should adopt a new business model.

Going digital is one of the best solutions for a financial institution to stay afloat and increase its competitiveness. The research conducted by the Massachusetts Institute of Technology shows that digitalization can enhance the cost-effectiveness of banks by 60-80%. The reason is that reducing physical interactions and moving primary financial services online enables fintech companies to personalize customer experience and cut compliance costs.

But despite all the benefits, incumbent financial organizations reluctantly blend their legacy systems with advanced technologies, and that's why they faced significant disruptions in times of the global pandemic. On the contrary, innovative banks and credit unions (like Revolut and Monzo) that had transformed their physical branches into customer-centric digital solutions survived and prospered even during the covid-19 outbreaks.

How Do Digital Sales Work in Banking?

The notion of digital sales refers to the company's ability to target particular customers via digital channels, offering them the right service at the right time. In the financial industry, major digital channels include online banking, ATMs, bank's mobile apps, and CRM systems.

But how exactly can digital sales perform in the financial field? To get the main idea, let's briefly compare the marketing practices implemented by traditional and digital banks.

Traditional Scenarios

Having such a variety of sales channels at hand, incumbent banks tend to ignore most of them. To engage with the clients, they employ physical branches, and let's be honest, fail even there. So, why does it happen?

Let's start with the most typical example. Frequently, to pay a loan or open a new account, people visit the nearest bank branches. After completing the operation, each customer gets the same ad leaflet offering additional banking services. Since these ads don't focus on each customer's individual needs, such a sales strategy delivers poor results.

Many banks try to sell their services via online banking or an ATM, which is ineffective for several reasons. Firstly, customers rarely visit a bank website (instead, they use a mobile app) or linger around ATMs (as there is often a queue). Secondly, such ads lack personalization; that's why they look like spam for many customers.

Also, incumbent banks tend to ignore cross-selling and up-selling practices while delivering their services. It leads to numerous gaps in customer expectations and reduces the potential revenue.

Innovative Solutions

The banks that underwent a digital transformation, on the other hand, leverage omnichannel marketing strategies and new business models, which enable them to click with the customers. So, how do they promote their services?

Imagine ordering your favorite pizza once a week and paying for the delivery by credit card. A month later, when you open a mobile banking app, you see the ad for a new credit card with a cashback reward at this very pizza place.

Another situation unfolds at the ATM. For example, you withdraw money each month and leave a certain sum on your balance. After this scenario repeats several times, one day a tempting offer about a high-interest deposit pops up on the ATM screen.

In both cases, you'll likely click on these ads and even accept the offer. Such an outcome is no coincidence; it's the result of the successful sales strategies implemented by digital banking. The combination of cross-selling and efficient digital tools (such as predictive analytics) allowed your bank to provide an excellent customer experience by delivering valuable services at a fitter moment.

Next-Gen Bank Branches: What Are They?

According to the survey, 80% of older people and reluctant technology users prefer traditional bank branches to digital banking services. So, to reach all the customers 24/7, most smart banks maintain both physical branches and digital channels.

But since the covid-19 pandemic has pushed forward online banking and contactless payments, the popularity of digital bank branches has definitely grown, and this trend is likely to continue. So, what are the smart bank branches of the future?

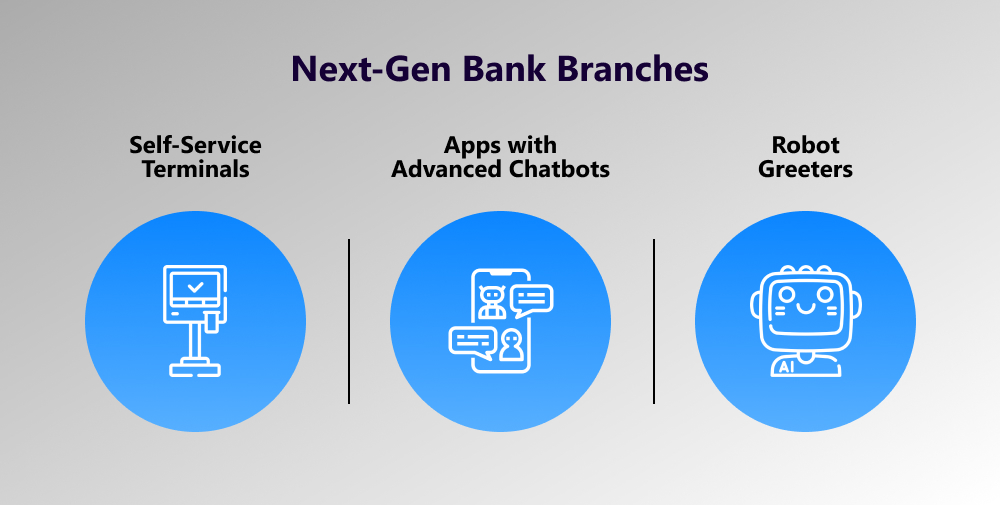

Self-Service Terminals

Such customer-friendly devices as self-service terminal systems (SSTS) have been in use for a while now. With their help, you can perform numerous transactions inside and outside bank branches. Simple interfaces, sound alerts, and QR code payments provide seamless user interaction, so the SSTS will likely replace traditional bank cashiers in some years.

Apps with Advanced Chatbots

In addition to self-service systems, smart bank branches also effectively employ AI technologies and data analysis to increase sales and attract new customers. Since embedding AI-powered chatbots in a traditional mobile app can enhance communication between a bank and a client and turn a simple application into a powerful sales channel, the challengers don't miss out on such digital tools.

Robot Greeters

If you seek innovations, robot greeters are something to look out for. Although such digital helpers are not so widespread yet, some IT experts believe it's only a matter of time. These robots are multilingual, non-emotional technologies capable of replacing major human interactions in banking. Since the covid-19 outbreaks continue, a robot greeter can become a perfect solution for bank branches.

Three Best Practices for Digital Sales Increase

Once the digital channels are chosen, it's high time to remember the Know Your Customer (KYC) rule. Also, if you want to retain clients and attract new ones, try to optimize your smart bank branches in compliance with the latest technologies. To achieve even better results and increase sales, you can use our tips below.

Stay Customer-Friendly

Making your client feel welcome should be a priority for any business, but traditional retail banks tend to forget it. So, don't repeat such mistakes and try to create a customer-friendly service instead.

For digital bank branches, it means creating an accelerated registration process and catchy design. Celebratory music after completing each operation can make the user interaction more enjoyable too. Also, keep in mind that the ability to apply electronic signatures and upload ID scans will enhance customer experience and expand the financial operations in your digital channel.

Provide Effective Support

24/7 support is also essential for digital bank branches. Since customers perform most operations by themselves in SSTS and banking apps, make sure they can easily open an account and won't face obstacles while making transactions.

Also, it's crucial to make each customer feel that your bank is always there to provide any assistance. So, in-time push notifications and advanced chatbots are the solutions to look for. But don't forget that these technologies require a support team.

Apply Advanced Digital Tools

Although nowadays customers can implement payments and basic transactions via a banking app and SSTS, there are still some complex operations that are difficult to perform online. Thus, you can easily transfer money, pay taxes, or renew insurance with just one click, but to receive a mortgage or clinch a huge deal, you still have to visit a bank branch.

At this point, the key goal of any digital branch is to facilitate all these processes for the customers by smoothing all the obstacles. And such advanced technologies as E-Statements, Digital Wallets, and Biometric Authentication will perfectly cope with this task.

Summing Up

Although digitalization is a challenging process, this risk is worth trying as it opens numerous possibilities for financial institutions. In case you still have doubts, just look at the success of the advanced fintech companies. The truth is that in today's competitive world the best solution to push forward your business is to go digital, so don't be afraid to change!

Please contact our specialists, if you want to optimize your financial services and don't know where to start. Qulix Systems is an expert in banking software development, so we will definitely find a perfect solution for your business.

Contacts

Feel free to get in touch with us! Use this contact form for an ASAP response.

Call us at +44 151 528 8015

E-mail us at request@qulix.com