Have you ever invested in crypto? And your granny? And your dog? Since today's global events cause extreme price fluctuations and disrupt the traditional exchange market, everyone who is trying to save their assets should plunge into the crypto world and study its rules. And, according to Statista, the trend for cryptocurrencies will only grow. As you know, most digital currencies operate on blockchain technology which unlocks multiple benefits for many fields. So, let's discuss how blockchain is changing finance.

Below, you'll find the basics of blockchain technology, its major applications in the financial industry, and much more.

written by:

Alexander Arabey

Director of Business Development

Have you ever invested in crypto? And your granny? And your dog? Since today's global events cause extreme price fluctuations and disrupt the traditional exchange market, everyone who is trying to save their assets should plunge into the crypto world and study its rules. And, according to Statista, the trend for cryptocurrencies will only grow. As you know, most digital currencies operate on blockchain technology which unlocks multiple benefits for many fields. So, let's discuss how blockchain is changing finance.

Below, you'll find the basics of blockchain technology, its major applications in the financial industry, and much more.

Contents

Blockchain Technology: Simple Explanation

Blockchain technology has been around for a while now. Still, the latest global events provoked an intense interest in its possibilities. Since the Ukrainians had to find new ways of protecting their assets, they switched to cryptocurrencies. At the same time, more Russians, trying to bypass the sanctions, started to use blockchain wallets.

But why did people choose this technology? To answer this question, let's briefly revise the blockchain basics.

What's the Idea?

Simply put, blockchain is an advanced way of transactional data storage characterized by extremely high reliability. All information, encrypted via a special algorithm (hash), is stored in blocks that are interconnected. So, it’s almost impossible to substitute the data in one block because it will cause changes in the hash value in all the others. And that's not the only reason for the technology's security.

Must Principles

So, what makes blockchain technology so invulnerable and secure? The reasons lie in the combination of its working principles:

- the absence of third parties or any intermediaries (like brokers, banks, governments) turns data exchange into a P2P transaction;

- it's a distributed ledger technology, which means all blockchain platform users have access to the transactional information;

- the data encryption/decryption processes, based on the idea of private and public keys, impede and prevent security breaches.

Easy-to-Get Example

To better understand the intricacies of blockchain technology, take a look at the following example. Let's say the workers got the task to build a red brick house. When half of the house was completed, one of the workers decided to steal some bricks and replace them with cheaper ceramic blocks. But once he started using new material, the other workers caught him red-handed and fired him.

However, this situation could lead to a different outcome. Imagine, our worker had managed to replace the bricks unwitnessed and complete his task. Still, when the house was finished, the other builders noticed that one wall differed from the others. They easily identified who was in charge of this wall, found the truth, and fired the culprit after all.

Blockchain technology operates in a similar way, i.e., all participants have access to a public database and can easily find a substitution. And this makes data fraud almost impossible.

How Can Financial Institutions Benefit from Blockchain?

A lot of people tend to identify blockchain with bitcoin transactions only. But thanks to its high-level security, this powerful technology has already spread all over the global financial system. So, let's pinpoint some other benefits it brings to the finance industry.

Reduced Costs & Boost

When it comes to settling transactions, you will certainly face the issue of commissions and speed. Since traditional banks have to purchase and maintain central databases, handle all the bookkeeping, and keep in mind labor costs and intermediaries' commissions, all money transfers slow down and increase in value.

The decentralized nature of blockchain eliminates these problems and allows financial companies to cut down extra expenses and accelerate the transfer process, which is extremely important for cross-border payments.

Data Immutability

Do you know that during the pandemic, the UK financial markets lost more than $1 billion because of transaction fraud? The hackers managed to substitute financial data and change the transaction history.

A blockchain network, on the other hand, is characterized by data immutability, which means once the information is recorded, it can't be changed or deleted. So, if the UK financial service providers had employed blockchain solutions, the losses would be much lower.

Enhanced Risk Management

Digital assets and risks are the notions that come hand in hand. Such processes like loan granting, credit scoring, and fund transfers require constant control and quality risk management.

Luckily, smart contracts and other blockchain solutions effectively overcome these challenges. And the great news is that different financial institutions (from commercial banks to venture capital firms) can employ them.

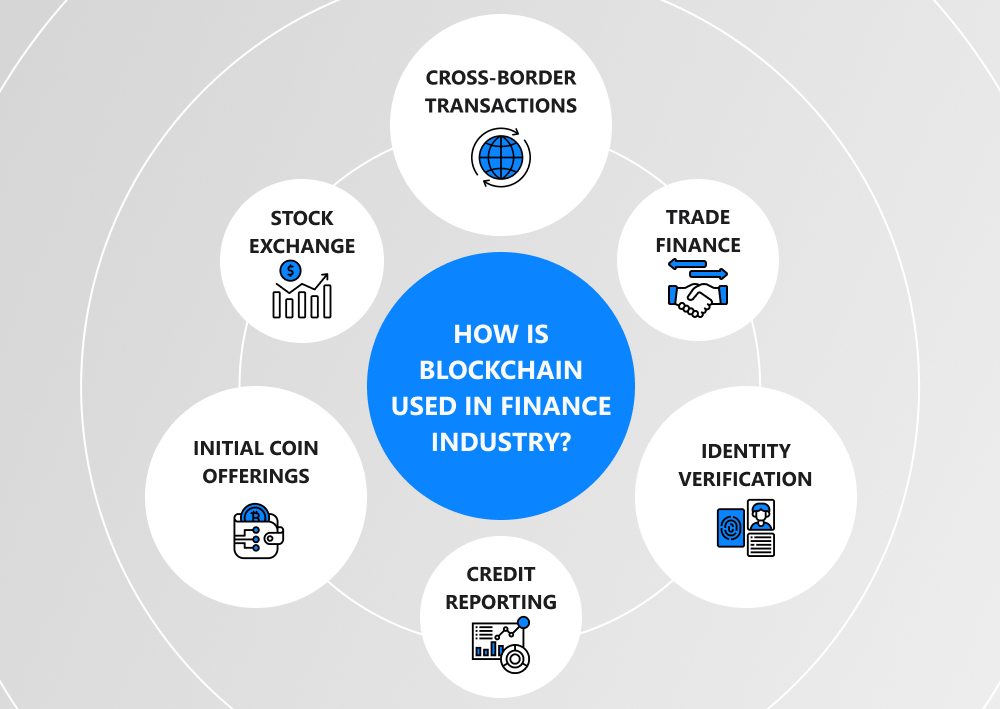

Blockchain in the Financial Services Industry: Use Cases

The use of blockchain in the finance sector is expected to increase and reach a $23 billion market size by 2026. So, what are the major applications of this advanced technology in the financial services industry? The answer awaits you below.

Cross-Border Transactions

Blockchain makes it possible to implement P2P transactions, both intrastate and cross-border. These transactions are faster and safer than traditional money transfers provided by financial intermediaries. And since payments are the backbone of finance, blockchain technology can easily become its future.

Stock Exchange

If you’ve ever traded stocks or bonds, you are familiar with this tedious expectation of getting the money transferred to your brokerage account. This happens because of the third parties (brokers, depositories, custodians) involved in the process. So, like in global payments, blockchain integration can remove intermediaries, which allows stock-market regulators to accelerate asset trading, and, therefore, reduce waiting time.

Identity Verification

Identity verification is a multistep process that is crucial for digital financial transactions. As a rule, it consists of face recognition, authentication procedure, and authorization. And when a client wants to change a service provider, he or she has to repeat these time-consuming steps. Still, the use of blockchain networks allows several service providers to securely reuse verification data, which can speed up the entire process.

Trade Finance

When dealing with commerce or international trade, you can also take advantage of smart contracts and decentralized ledger technology, e.g., to relieve the burden of paperwork (bills of lads, invoices, etc.) and bureaucracy involved in trade finance. Thus, by integrating blockchain into their systems and creating a single digital document updated in real-time (instead of keeping several copies), trading partners can streamline the business processes.

Credit Reporting

Credit scoring and reporting are the eternal challenges of the banking industry. To assess a client's creditworthiness or create a detailed report, financial companies should be able to effectively analyze credit history and detect possible fraud. Since blockchain records are immutable and transparent, lenders can employ them to impartially assess a potential loan borrower.

Initial Coin Offerings

You've probably heard of the IPO process, so the Initial Coin Offering (or ICO) is pretty similar to it. The notion refers to crowdfunding for new tokens, where investors buy shares for cryptocurrencies or physical currencies. So, blockchain technology can also be implemented for this procedure and increase its transparency and speed.

Some Food for Thought

Although the use of blockchain in financial services can significantly enhance the industry, you should not forget about its pitfalls. For example, this technology still lacks proper regulation and legislation, which complicates transactions in certain countries. Also, the blockchain-based data verification process requires further development and explicit standards. On top of that, the technology needs more transparency (especially, when it comes to the exchange rates between digital coins and other currencies). But anyway, it does have a promising future.

Please, contact our specialists to learn more about the benefits this cutting-edge technology may bring to your business. Qulix Systems is a real expert in all kinds of blockchain solutions ready to offer you quality, reliability, and security.

Contacts

Feel free to get in touch with us! Use this contact form for an ASAP response.

Call us at +44 151 528 8015

E-mail us at request@qulix.com