The fintech industry is drastically transforming standards for banking and financial services. Today we prefer tech-enabled options and digital financial access. So no wonder that fintech companies raised $40.3 billion in funding in 2023, according to CB Insights, and the industry is developing lightning fast. Meanwhile, cyber threats have grown exponentially, with the cybercrime epidemic costing the world $6 trillion last year. Therefore, fintech security companies never cease their efforts to protect our money.

With this in mind, we made our top five of the most exciting companies that help the financial industry provide secure products and services.

WRITTEN BY:

Alexander Arabey

Director of Business Development

Contents

Fintech Security Challenges

The last two years will go down in history as the time when just about everyone had to change the usual way of personal and professional life. Fortunately, the existing technology and services allowed us to adjust to the changing environments in everyday life, studies, and business. For example, fintech companies expanded opportunities for businesses to provide safer and more accessible contactless financial services.

At the same time, the growing popularity of fintech products has led to the rise of hacker attacks, fraud, and financial data breaches. All in all, with cybercrime happening every 39 seconds, the tech industry has lost about $6 trillion this year. Ever suffered from phishing emails? Then, the fact that it's the most common kind of attack will hardly surprise you.

Moreover, according to the report by Accenture, of all the industries studied, the highest cybercrime cost was borne by the financial services sector.

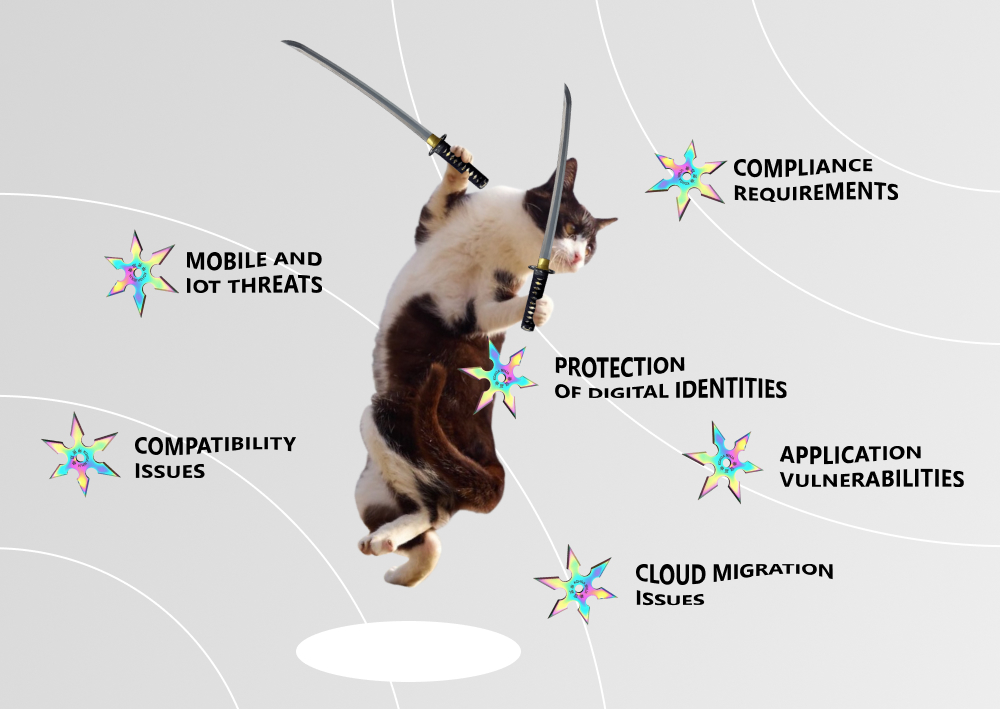

Let us have a look at the main security challenges in fintech.

- Application vulnerabilities. Fintech strongly depends on a secure fintech app. Applications are the primary targets to exploit vulnerable code and enter fintech networks and infrastructures.

- Mobile and IoT threats. Various mobile platforms and IoT devices are extensively used for payments these days. If violated, a hacker gains access to financial data via numerous points of entry. It is a challenge for a fintech software development company to secure standards for all devices.

- Compatibility issues. Fintech providers often integrate their solutions with third-party products and rely on outsourcing companies. Systems from several different providers and their compatibility can cause data breaches and detecting potential vulnerabilities and fintech security risks can become challenging.

- Cloud migration issues. Cloud services have become essential for many fintech companies thanks to lower costs and better performance of cloud-based financial products. However, storing critical data in the cloud requires security solutions that differ from a traditional data center or network.

- Protection of digital identities. A fintech app enables users with easy access to their accounts via various devices and wearables, and that can become a gateway for cybercriminals to customers' assets and data. So, to prevent cloning digital identities and data leakages, it is essential to apply multi-factor authentication and electronic identification.

- Compliance requirements. Fintech services and products must meet regulatory safety requirements (the GDPR, PSD2, and similar) to provide strong data protection and avoid regulatory fines.

This list of challenges can be extended with human error prevention, getting the best balance of convenience and security, and other difficulties. Moreover, there is no doubt that this list will be continued with new examples of attacks and security challenges. Fintech keeps on developing, and so do cybercrime methods.

Fintech Security Top Names

What companies are on the frontline of the data security battle? We handpicked for you five exciting projects in the fintech security industry.

Bluefin Payment Systems — Data Encryption and Tokenization

Bluefin Payment Systems is one of the notable leaders in tokenization and encryption technologies for data security and payment protection. The company is a Participating Organization of the PCI Security Standards Council. Over 20 thousand companies in 46 countries use Bluefin products.

Bluefin most notable products are:

- ShieldConex®. It is a data security platform that applies hardware-based encryption and tokenization. The platform is used to secure clients’ sensitive data entered online. ShieldConex masks cardholder data (CHD), Personally Identifiable Information (PII), and Protected Health Information (PHI) upon entry through APIs or Bluefin iFrame. The data never travels through a network or a system as a clear text.

- PayConex®. It is a multichannel payment-processing platform. PCI-validated point-to-point encryption (P2PE) for point-of-sale payments and ShieldConex® provide a higher level of platform security.

- QuickSwipe®. It is a P2PE solution for protected on-the-go mobile payments. The platform is used for encrypting credit card pins within a PCI P2PE approved point of entry device. No clear-text cardholder sensitive data enters the merchant’s system or network.

- Decryptx®. It is a platform for connecting to Bluefin P2PE. It offers cost-effective solutions for small businesses and provides payment security solutions seamlessly integrated into any merchant’s devices.

In 2023, the CyberSecurity Breakthrough Awards recognized ShieldConex® Data Security Platform as “The Enterprise Encryption Solution of the Year.”

Forter — Financial Fraud Prevention

Forter is one of the leaders in e-commerce fraud prevention. Its platform annually processes over $250 billion in e-commerce transactions and protects more than one billion customers from account takeover, credit card or identity theft, and other cybercrimes.

Forter’s ecosystem is a global network that unites payment providers, banks, and merchants to fight fraud together. The platform offers predictive modeling and fraud research. The customers can adapt the platform to their particular needs. Today Forter's primary risk mitigation engine is used by Adobe, Farfetch, Priceline, and Sephora. These solutions enable its partners to deliver exceptional accuracy, smooth user experience, and high sales figures.

Frost & Sullivan named Forter the market leader in fraud prevention in their latest “Frost Radar in the US eCommerce Fraud Prevention Market” report.

Riskified — Secure Transactions

Riskified is an acknowledged outsourcing vendor of financial technology for fraud and chargeback prevention. Its SaaS solutions are tailored for eCommerce enterprise merchants.

Riskified's financial technology stack includes applying machine learning algorithms, elastic linking, behavioral analysis, and proxy detection. Security solutions help provide efficient differentiation between legitimate purchases and financial fraud.

Customers use Riskified’s secure fintech platform across various verticals. Its partners are TicketMaster, AirEuropa, Wish, Agoda, Prada, etc. Merchants can offer their clients several alternative payment methods and prevent account misuse.

Moreover, businesses benefit from increased bank authorization rates for faster and frictionless service. All the transactions backed by Riskified technology receive a full money-back guarantee in the case of fraud and get protection from chargebacks.

In August 2023, the company filed for an IPO on the New York Stock Exchange with the ticker symbol RSKD.

Onfido — Unauthorized Access Blocking

Onfido sees its mission in reinventing data protection through secure biometric adaptive authentication solutions. The company has set new standards for identity verification by AI-based technology. The solution compares users' government-issued IDs against users' facial biometrics. Onfido enables businesses to widen options to access financial data, minimize friction, and prevent identity fraud and privacy upholding.

Onfido solutions, powered by machine learning algorithms, are used by a broad set of industries — healthcare, transport, gaming, eCommerce, retail, and various financial services. The Onfido-powered secure fintech app offers tailored configurations that help its customers meet KYC, AML, and other local financial security requirements.

At the RSA Conference 2020, Onfido got the InfoSec Award for the Best Next Gen Fraud Prevention Product.

Symphony — Verified Electronic Identification

Symphony offers a fintech security compliance platform that enables companies with data security solutions for standardized, innovative, and automated fintech data workflows.

The platform is more than just a space — it's a thriving community of over 500,000 verified financial technology professionals. Through multichannel interactions, members can seamlessly connect with their clients via encrypted chats, secure meetings, and popular services, ensuring a smooth and glitch-free communication experience.

The Symphony platform hosts over 2 thousand community-built secure fintech apps and bots. Liquified transaction workflows on the platform help provide financial services efficiently and solve market pain points.

The platform awards its best community contributors with the Symphony Innovation Award. They choose the best data protection and security audit solutions that help improve the financial services industry within the Symphony community.

Bottom Line

So, what are the main directions for fintech security development? The companies mentioned above offer fintech security solutions and advanced financial technology based on AI-powered innovations, encryption practices, tokenization, and blockchain.

We believe that the lack of cybersecurity is one of the main reasons for fintech business failures. That is why the software development life cycle requires a professional IT security audit at all its stages. It is crucial to choose a reliable outsourcing partner that complies with high standards of software security delivery.

If you want to know more about our unique competencies in fintech software development, don't hesitate to get in touch with our specialists. Qulix has rich experience in secure product development and delivery.

Contacts

Feel free to get in touch with us! Use this contact form for an ASAP response.

Call us at +44 151 528 8015

E-mail us at request@qulix.com