According to Innovate Finance, global investments into the fintech industry reached $102 billion in 2021. Experts expect the fintech market value to grow to $310 billion by 2022. It is explained by the recent rapid development of the financial sector. In order to remain competitive, banks and financial institutions must meet the demands of consumers who want to use convenient, reliable, and secure financial technology solutions. You need to hire fintech developers if you want to create such products.

Read our article to learn how to organize a hiring process, what skills and competencies fintech developers should have, and where you can easily find them.

written by:

Alexander Arabey

Director of Business Development, Qulix Systems

According to Innovate Finance, global investments into the fintech industry reached $102 billion in 2021. Experts expect the fintech market value to grow to $310 billion by 2022. It is explained by the recent rapid development of the financial sector. In order to remain competitive, banks and financial institutions must meet the demands of consumers who want to use convenient, reliable, and secure financial technology solutions. You need to hire fintech developers if you want to create such products. Read our article to learn how to organize a hiring process, what skills and competencies fintech developers should have, and where you can easily find them.

Contents

Fintech Software Development: An Overview

The financial industry is currently experiencing an explosive growth of new fintech solutions. According to Statista, there were almost 11k fintech startups in the US, more than 9k ones in the EMEA region, and over 6k projects in Asia as of November 2021. All of them strive to meet the needs of modern consumers who already got used to fast and convenient financial transactions ensured by easy-to-go fintech apps. The COVID-19 pandemic has accelerated the digitization process when the interest in mobile apps and payment gateways significantly increased. Before exploring how to find fintech software developers, let's see what solutions are popular now among customers.

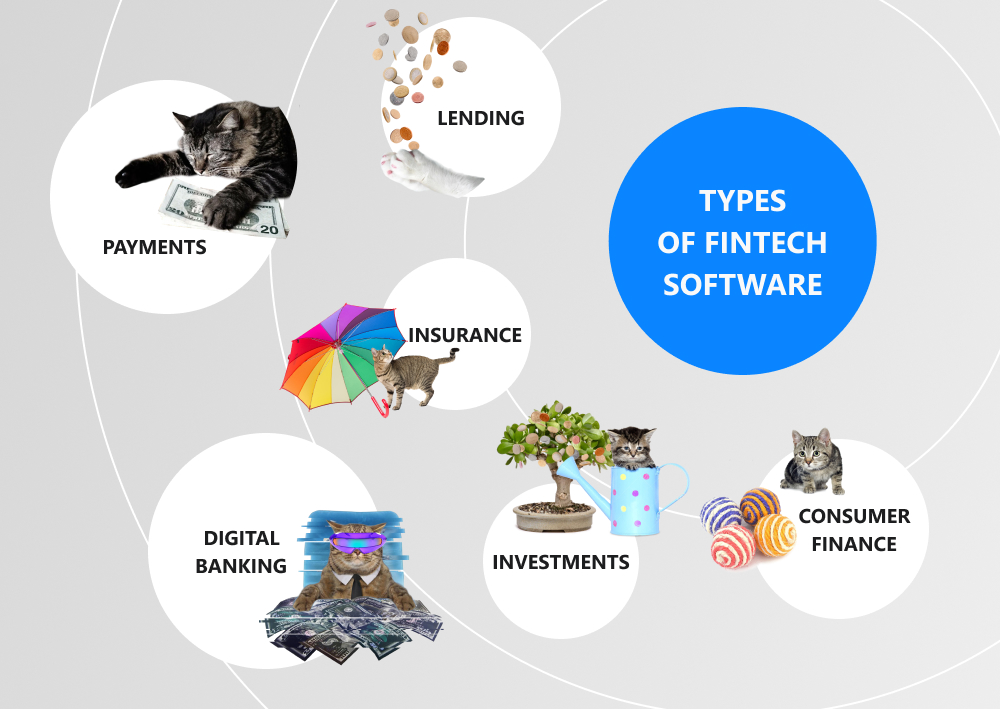

Products Provided by Fintech App Developers

If you want to find success in the fintech sector, you should acutely understand what software solutions you will offer to customers. A clear picture will help a fintech developer translate your idea into reality and fully meet your business requirements. Hire developers who will be able to create the following products:

Personal Finance Apps

They help users manage their finances, analyze costs, and forecast expenses. In addition, these applications can give tips for saving money, analyzing financial habits, depositing assets, and have other features.

Payment Apps and Digital Wallets

They allow users to pay for products and services online from the comfort of their homes. These apps will inevitably be in demand with the population. Statista estimates that the value of global digital payments will reach almost $8 million by 2022. The task of your fintech programmers is to create a customer-friendly and highly secure solution.

Investment Apps

They include robo-advisors, digital brokers, micro-investment platforms, and asset management programs. The investment applications track prices for shares and cryptocurrencies, as well as notify users about price changes, give advice on investments and portfolio diversification, and so on.

Money Transfer Apps

They allow users to transfer money without the involvement of any banks and payment of transaction fees. These solutions can support both fiat money and cryptocurrencies.

Lending Apps

They help users take out loans quickly and seamlessly. These products are often based on artificial intelligence and machine learning algorithms that automatically assess creditworthiness. Chatbots facilitate communication and settlements between lenders and borrowers, automatically fill in loan application forms, as well as effectively manage loan procedures.

Insurance Apps

They are used to automate insurance payments. The applications send notifications about insurance payments, policy expiration dates, promotions and new offers, send documents to the required institutions, and give advice on settling insurance claims. For example, car insurance mobile apps can monitor the driving style of users and, based on this information, select the appropriate insurance policy.

The same solutions are in demand among corporate customers. They can be interested in financial analytics, wealth management, cloud computing, and B2B platforms as well. Companies need products and services that will be able to automate their business processes, improve accounting, increase employee productivity improvements, and much more.

When you decide what product you want to develop, it's time to find experienced fintech developers who will take care of your project. There are three approaches to hiring fintech specialists: outsourcing, freelancing, and in-house software development. Let's explore them right now.

3 Ways to Hire Fintech Engineers

Fintech Development Outsourcing

If you don't have the necessary level of knowledge or resources to successfully implement your projects, you can hire dedicated fintech developers. Reliable outsourcing companies have the latest technologies and deep expertise to build an effective fintech solution. You tell your partner about your idea and business needs, control the development process, and accept the finished product.

Outsourcing solves the problem of finding narrow specialists with certain skills that cannot be found locally or within the company. This collaboration model allows you to work with professionals from all over the world. While they are working on your fintech project, you can focus on the internal processes, marketing, financial strategy, business development, and so on. Moreover, you don't need to employ in-house teams, pay taxes, and incur expenses on salaries and equipment. You can also hire developers from countries with low labor costs and save up to 60-70%.

But you need to spend time looking for a reliable and financially stable fintech software development company that will make a high-quality solution for you on time. When choosing an outsourcing provider, it's important to take into account its location, as well as the political and legal situation in the country. Be aware of time differences due to different time zones in order to make a comfortable schedule for your employees. Cultural differences between team members, an inability to properly understand each other, poor communication skills, or language barriers should be considered, too.

Freelance Fintech Developers

Another option to find professionals with the required skills is to contact a freelance fintech developer. It's cheaper to deal with freelancers than with software companies. They are interested in delivering high-quality products on time in order to receive customer's recommendations and proceed to the next projects. However, this way of cooperation has a number of disadvantages, such as privacy risks, lack of guarantees, scaling difficulties, high load, and maintenance issues. In spite of good reviews, freelance developers may have unforeseen circumstances and leave the project. If you're hiring freelancers, you'll need to bring them together, but they won't work as a whole team.

Another major hurdle is security risks as freelancers can be engaged in several projects at the same time, including your competitors. That's why a freelance fintech app developer may be unavailable when you need him/her again to solve any urgent problems or update the product. For this reason, freelancers don't want to maintain or update the apps. Therefore, you will have to find another specialist, which will take time and money.

In-house Fintech Developers

In contrast to the above-mentioned models, in-house development ensures complete transparency and full control of workflows. In-house fintech developers will be fully involved in the project, resulting in much less time needed for software maintenance because they will know all the ins and outs. When people work side by side, it's easier and faster for them to solve any issues without waiting for a colleague's reply from another part of the world.

This approach has a number of disadvantages as well. Firstly, maintaining your own development team is expensive since you will have to spend money on salaries, sick days, vacations, insurance, pension contributions, taxes, equipment, office rent, and so on. Keep in mind that finding a fintech talent can take a long time. For example, it takes 43 days on average in the USA to hire one programmer. If you want to employ 5-7 fintech developers, you'll spend 2-3 months.

Where Can You Find Fintech Developers?

Once you have chosen the cooperation model that suits you, you should think about places where to find the required professionals. There are several online platforms where you can search for specialists or fintech companies. If you decide to gather an in-house team, go to LinkedIn, GitHub Jobs, Glassdoor, and CareerBuilder. If you decide to hire freelancers, use specialized platforms like Upwork, Freelancer, Codementor, PeoplePerHour, Guru, Hired, and Toptal. There you can explore the portfolios, reviews, ratings, feedback, and much more. To find a trusted outsourcing service provider, visit Clutch, GoodFirms, Techreviewer, and other websites. They publish reviews and carefully check all the information.

Besides, you can visit thematic communities, forums, and chats where programmers hang out. Stack Overflow, The Verge, Code Project, and XDA Developers are the most popular platforms. Developers come there to communicate, share experiences, ask for help, and look for mentors. You can contact any specialist, conduct an interview, discuss the details, and offer them to join your project.

What Skills Should Fintech Developers Have?

So, you know where to look for fintech developers. Now, it's time to find out what knowledge and competencies your future development team should have. A fintech software engineer must be able to work in a specialized team development environment, understand the principles of distributed systems architecture, mathematical models, and processes that are used for risk analysis.

The programmer must know the principles of automation and monitoring, technologies and specifications, as well as testing methods. The qualification of a developer includes relevant experience, knowledge, and professional skills. Every specialist must constantly foster their skills. As a rule, developers are invited into three groups depending on their competencies and expertise:

- Junior

- Middle

- Senior

What kind of specialist do you need? Everything depends on your project requirements and expectations. In general, developers should have the following skills:

Hard Skills

Fintech products are created by frontend and backend developers. Obviously, they need to know programming languages , such as Python, Java, C++, C, Go, JavaScript, CSS, HTML, Ruby, PHP, and others. In addition to writing code, programmers must be able to test it, as well as understand algorithms and data structures.

Frontend developers should be able to layout, understand the principles of working with SVG objects, the DOM model, API requests, know the basics of UI/UX design, adaptive layout, cross-browser compatibility, and cross-platform software. They should be able to work with various libraries and frameworks. A backend developer must know server programming languages and be able to manage databases. If you are creating a mobile fintech app, look for professionals who work with iOS SDK, Xcode, Objective-C, Swift, and so on.

Soft Skills

In addition to the tech stack, your team needs to develop soft skills to be able to easily interact with each other. They include:

Communication skills - the ability to negotiate with people, compromise, interact with colleagues, explain and defend one's opinion.

Creative thinking - the ability to apply out-of-the-box solutions and implement non-standard ideas.

An ability to process information - to search and analyze data, as well as draw conclusions. It's the desire to obtain new knowledge, the ability to self-development, interest, curiosity, and so on.

Self-organization - the ability to effectively plan and organize work activities, properly manage time, meet deadlines, etc.

Stress resistance - the ability to effectively cope with problems, maintain efficiency, calmly accept criticism, have high frustration tolerance, and so on.

Wrapping Up

AppFlyer revealed that the demand for fintech apps is currently growing. It jumped by 132% worldwide and by 110% in the USA alone. The report also demonstrates that customers actively download and use them because digital solutions fully meet their need for cashless, fast, and secure money transfers. It's no wonder that banks, investors, insurance companies, and lenders seek to create fintech solutions that will help them automate and optimize their business processes.

Thus, all industries will implement fintech apps to their corporate infrastructure and gain profit in the future. Taking into account the rising demand for digital products, current market conditions, and a wide range of development opportunities, it's time to find experienced fintech app developers and build your own solution. According to Statista, mobile app revenues will exceed $935 billion in 2023. Don't miss your chance to join the promising market and ride high there.

At Qulix Systems, we are ready to consult you about the fintech software development process or how to hire fintech developers who will be able to create a successful app. For more details, please visit our website or get in touch with our support team.

Contacts

Feel free to get in touch with us! Use this contact form for an ASAP response.

Call us at +44 151 528 8015

E-mail us at request@qulix.com