Today companies have not only to survive during pandemic times but also keep their wits above one to stand against various hacker attacks and fraudulent activities. Businesses worldwide lost $42 billion due to fraud, according to the PwC’s Global Economic Crime and Fraud Survey 2020. To protect their revenues and confidential information, companies used rule–based systems for fraud detection, which turned out to be ineffective because cybercriminals found ways on how to override them. That's why fraud detection machine learning solutions are gaining popularity now. Let's see how they can keep your sensitive data and money safe from attackers.

written by:

Anton Rykov

Product Manager,

Qulix Systems

Today companies have not only to survive during pandemic times but also keep their wits above one to stand against various hacker attacks and fraudulent activities. Businesses worldwide lost $42 billion due to fraud, according to the PwC’s Global Economic Crime and Fraud Survey 2020. To protect their revenues and confidential information, companies used rule–based systems for fraud detection, which turned out to be ineffective because cybercriminals found ways on how to override them. That's why fraud detection machine learning solutions are gaining popularity now. Let's see how they can keep your sensitive data and money safe from attackers.

Contents

Are Fraud Offenders Everywhere?

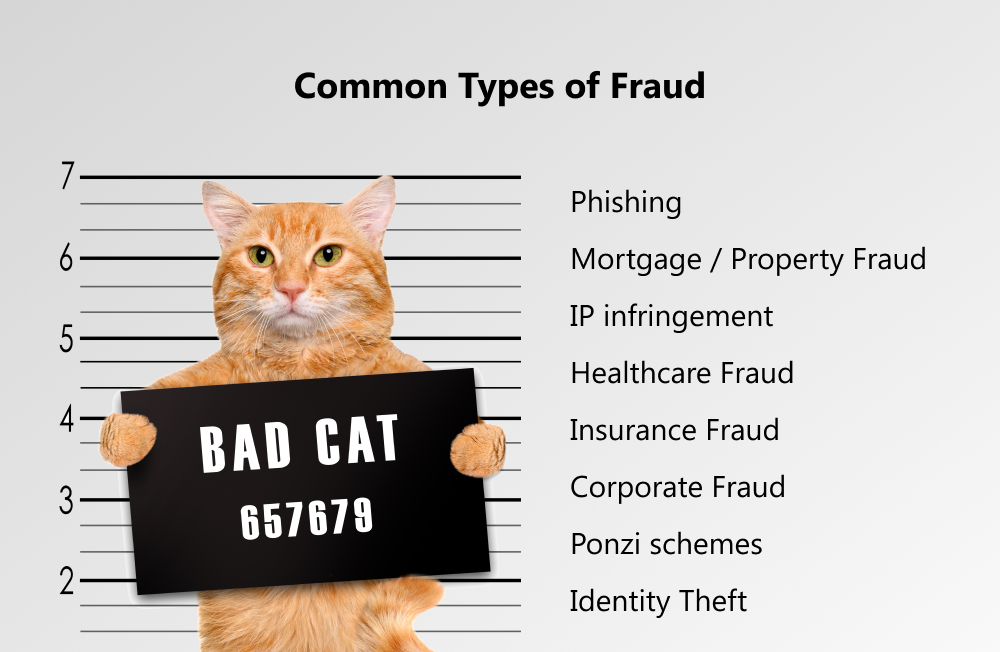

When we talk about cybercrime, the banking and fintech sectors are the first things that pop into our minds. Fraudsters hunt for our credit cards and bank accounts using malicious codes, phishing, skimming, social engineering, carding, Nigerian letters, and other fraud schemes. According to the Nilson Report, the credit card fraud losses amounted to $28.65 billion in 2019. It's no wonder that businesses from all over the world are looking for effective and accurate credit card fraud detection systems.

However, scammers are not limited to the financial industry. They have penetrated into healthcare, the insurance industry, mobile marketing, digital advertising, and other branches for a long time. Can you imagine that the World Federation of Advertisers called ad fraud the second biggest organized crime after drugs? Fake IPs, click scamming, ad injection, ad stacking, pixel stuffing, install hijacking, click injection, abnormal patterns of CTIT, and fake supply are often used by fraudsters to drain marketing and advertising budgets.

Like marketers, insurers also suffer from fraudulent activities. Top common scammy schemes include misrepresentation of insurance events, fake insurance contracts, fake car theft, and much more. According to the FBI, there are over 7k insurance companies operating in the USA. Every year they earn $1 trillion in premiums and lose more than $40 billion due to fraud. Insurance market participants expect machine learning fraud detection solutions to help them solve this huge problem and save their money.

The World Health Organization (WHO) has been concerned about the extent of healthcare fraud for a while. Criminals apply a wide range of cyber scams from distributing fake drug orders to stealing and selling patient data or establishing companies that exist only on paper to bill insurance companies for bogus patient services. The coronavirus pandemic only made the situation worse. Fraudsters began to create viral websites that spread malicious software to steal personal information or payment card data. The attackers also offered people to buy fake filter masks, miraculous drugs for COVID–19, fake vaccines, fake tests, and so on.

One needs to analyze huge amounts of data in order to detect fraud. For this purpose, businesses need to implement and use specialized anti–fraud systems. Rule–based fraud detection solutions are unable to analyze in detail a large number of different parameters and their correlations. Therefore, you can't rely on the accuracy and completeness of fraud detection provided by these tools. What are their weak points?

Are Rule–based Methods Ineffective?

These systems are based on signature detection of illegitimate transactions. They allow you to detect certain fraudulent activities, but they have a number of disadvantages, such as:

- Inability to detect fraud in real–time mode;

- Inability to process huge data sets;

- Inability to adapt to new fraudulent methods and attacks;

- Necessity to carry out additional checks because the fraud detection rule–based systems analyze transactions determined by experts (e.g., too large or frequent transactions);

- Necessity to create updated old rules and create new ones;

- Strong dependence on fraud detection analysts.

This is where machine learning fraud detection solutions come to the aid. Machine learning algorithms automate the analysis of huge amounts of data sets that can't be processed manually and analyze a great number of metrics along with correlations between them. This allows them to reduce the risk of missing potential fraudulent transactions and not to increase the false positive rate. Let's find out how companies can use machine learning for fraud detection.

Fraud Detection: Machine Learning Solutions Rush to the Rescue

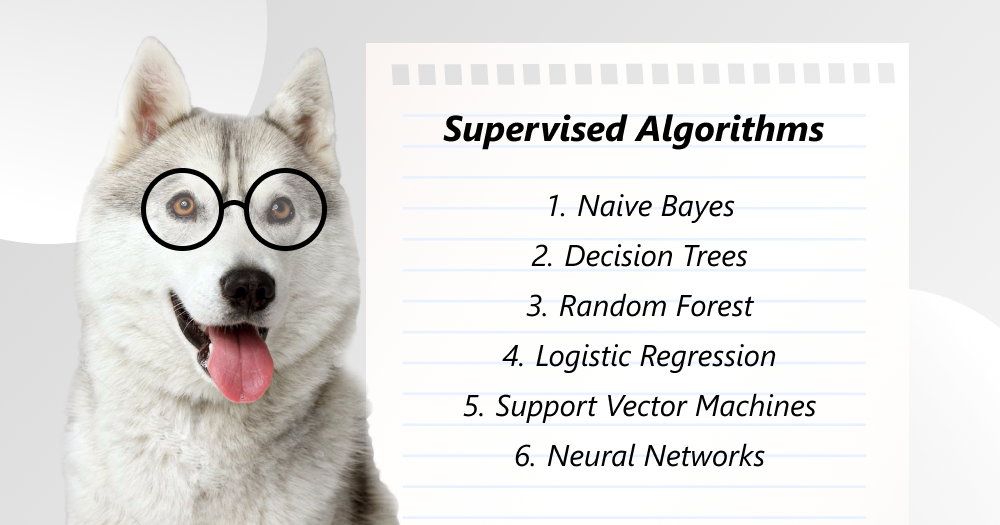

You can use both supervised and unsupervised machine learning algorithms to detect fraud. The first model applies classification algorithms when there is a training sample with previously known answers. The second one doesn't contain any answers, and a machine learns by itself. The classification algorithm will help us detect fraud using machine learning techniques or statistical analysis. It is used for spam filters and the detection of suspicious transactions. You can teach the machine learning model or calculate the probabilities for two classes (legitimate and fraudulent transactions), and apply the model to new transactions to determine their legitimacy. Let's take a closer look at the supervised fraud detection machine learning algorithms. They include:

Supervised Fraud Detection Machine Learning Algorithms

Naive Bayes

This algorithm is based on Bayes' theorem assuming that every feature is independent of any other feature. Taking into account the categorical features along with the categorical class labels, Naive Bayes calculates the probability for each category from each function by each category of the class labels. Thus, it will select the particular category of the class label, which is the most likely.

Previously, this machine learning model was used for all spam filters. How did it work? For example, the machine counted how many times the word "casino" appeared in spam and how many times it was met in normal emails. Then it multiplied the two probabilities using Bayes' formula and added up the results of all the words. However, spammers managed to bypass the Bayesian filter by simply inserting many "good" rated words at the end of the email. As a result, this method was renamed Bayesian poisoning.

Decision Trees

A decision tree is a structure that looks like a flowchart and shows the possible consequences of a series of related decisions. This model allows us to assess various options, taking into account the probability levels, benefits, and costs. It usually starts with a single node that splits in possible options. Every option leads to additional nodes that branch out into new options.

There are three types of decision tree nodes:

- probability of one or another result;

- decision that should be taken; and

- end result, to which the decision branch leads.

This machine learning algorithm is often used by banks to access customer credit solvency. For this purpose, the machine examines the bank's database with the customer profiles who earlier took out a loan. It analyzes their age, salary level, position, and other data. But its main task is to reveal who repaid the loan on time and who didn't. This data allows the machine to identify fraud patterns and make predictions for a particular customer.

Random Forest

The random forest machine learning model is an ensemble version of the decision tree method. Simply put, it represents multiple decision trees, which increases the prediction reliability. Researchers found that random forest can be successfully used to detect fraud transactions in the finance sector and e–commerce.

Logistic Regression

This machine learning model establishes a relationship between variables and a class. It is usually used to predict a class of events where there is a predefined and known category of events. The dependent variable is indeed a categorical variable, but the internal work of the logistic regression algorithm transforms the variable using the logit function, which calculates the log odds ratio for events and, therefore, builds a linear equation for them. It allows us to see that the report or transaction is fraudulent. This model demonstrated excellent results in fraud detection in credit cards with a 97.2% accuracy.

Support Vector Machines

This supervised machine learning algorithm uses a technique, known as the Kernel Trick, to transform the data. Based on the transformation, it finds the optimal separation between the possible outputs. The algorithm represents classes in a hyperplane in a multidimensional space and finds the ideal separator for the classes, which is known as the maximum marginal hyperplane. Support vectors are data points that are close to the hyperplane, which, in turn, is the decision plane that is split. The margin is a gap that is calculated between the two classes.

Neural Networks

A neural network is a mathematical model that operates by analogy with the human brain. The neural networks are currently used to recognize and process speech and images, manage navigation systems, detect illegal content and fraudulent actions, protect information systems from attackers, and so on. The global neural network market size stood at $11.3 billion in 2020 and is expected to reach $27.36 billion by 2026, according to MarketWatch. The neural networks help machine learning models determine the correctness of previously identified anomalies and increase the fraud detection accuracy.

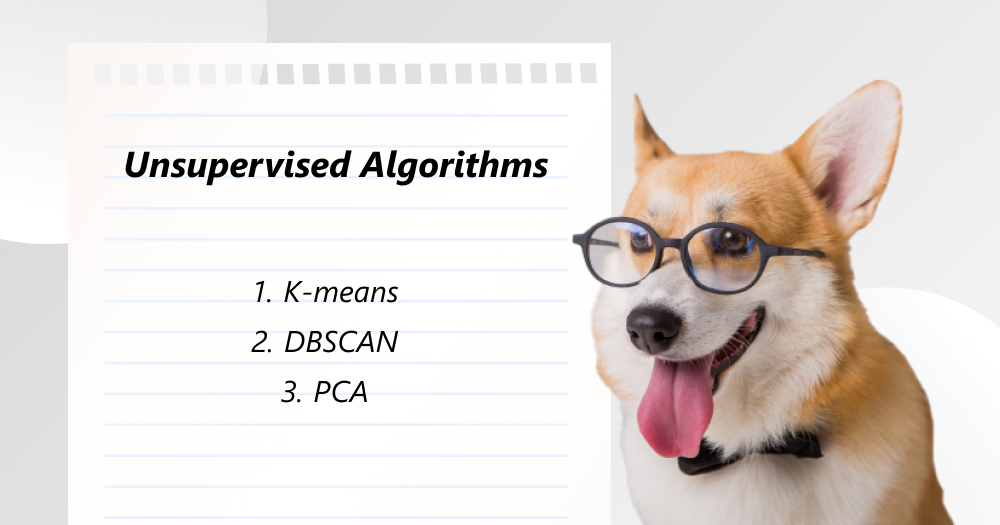

Unsupervised ML Algorithms

Unsupervised machine learning techniques are used to detect anomalies and hidden variables. In this case, the model has data sets but it doesn't know what to do with them. The idea behind this approach is that the machine will find data correlations by itself and analyze them. This model is known as clusterization. The machine looks for similar objects and clusters them in accordance with the defined features. The objects with similar features are put into one class. There are the following types of machine learning for fraud detection:

K–means

K–means clustering is a process that helps us divide data points or observations into k unknown clusters in such a way that each observation clearly belongs to the cluster. This associativity of a cluster is determined by the proximity of that data point to the closest mean, known as the cluster centroid. Since a proximity measure is involved in data, we use various distance algorithms to measure the proximity of the data to the center of the cluster. The Kenyan researchers developed and tested the K–means clustering model for the fraud detection of medical claims. They came to the conclusion that this method is effective for fraud management in the medical and insurance sectors.

DBSCAN

DBSCAN, or the density–based spatial clustering of applications with noise, works with data density. It finds clusters of points and builds clusters around them. Let's imagine that points are people standing in the yard. You see three people standing close to each other and ask them to link arms. Then you ask them to take the hand of those who are nearby. The first cluster will be ready when nobody is able to take anybody's hand. Those who have no one to take by the hand are anomalies. For example, this machine learning method can be used to detect a fraudulent transaction due to abnormal customer behavior.

PCA

PCA, or principal component analysis, is a dimensionality reduction algorithm that is useful for reducing the number of variables in huge data sets by transforming a group of variables into one large variable while preserving the initial features of that set of variables. For example, the Microsoft Azure Machine Learning cloud service uses PCA to predict fraud by detecting anomalies.

Final Word

So, machine learning allows us to create models that are intelligent enough to correctly classify transactions as legal or fraudulent. At the same time, ML algorithms decrease false positives, reducing financial losses, improving the quality of service and customer loyalty. That's why the popularity of such instruments is gaining momentum now. SAS and ACFE revealed that the usage of fraud detection solutions based on artificial intelligence and machine learning would grow by 200% in 2021.

If you are interested in implementing an instrument based on machine learning for fraud detection and need professional advice, contact us or visit our official website for more details. The Qulix System experts are ready to share with you their knowledge and expertise.

Contacts

Feel free to get in touch with us! Use this contact form for an ASAP response.

Call us at +44 151 528 8015

E-mail us at request@qulix.com