Remember the start of your customer journey at a favorite pizza delivery? One day, you probably got an ad leaflet or saw a catchy billboard right outside the local supermarket and decided to visit a pizza delivery website. After scrutinizing the offers, you made the first order. Later, a manager called you to clarify the details, and your customer data was forever saved on that very website. Now, you get delicious pizzas there just in one click, right? In fact, this is a vivid example of the omnichannel strategy at work. But what is omni-channel in banking?

The answers to this and many other questions await you below. Enjoy your reading!

written by:

Alexander Arabey

Director of Business Development

Remember the start of your customer journey at a favorite pizza delivery? One day, you probably got an ad leaflet or saw a catchy billboard right outside the local supermarket and decided to visit a pizza delivery website. After scrutinizing the offers, you made the first order. Later, a manager called you to clarify the details, and your customer data was forever saved on that very website. So, now, you get tasty pizzas there just in one click, right? In fact, this is a vivid example of the omnichannel strategy at work. But what is omni-channel in banking?

Contents

How Are Financial Institutions Doing Today?

Before revealing the concept of omnichannel banking experience, let's have a quick look at the current state of the US banking sector (since what happens there frequently impacts the global banking industry).

One of the most burning issues today is the increase of the federal funds rate (FFR) target up to 3–3.25%. Although such measures are supposed to combat record-high inflation and lots of investors set positive expectations for the US stock market, financial institutions and bank customers are facing a harsh reality. Hopefully, this situation won't last long. But the bad news is that it's not the only challenge most banks have to address now. So, what are the others?

Tough Market

With over 30k fintech players in the market field, it is becoming more difficult for traditional banks to go up against the competitors. Today, digitization keeps conquering the financial services industry, offering it the latest digital marketing techniques that push forward sales network capabilities. And unfortunately, those who resist its influence have to step aside.

High Expectations

Do you know that Gen Z makes up over 21% of the US population? And this proactive and tech-savvy generation expects the latest technologies to meet their demands 24/7. The Millennials (making up over 22%) also depend significantly on digital tools, preferring to use a mobile app rather than interact with a human banking consultant in the real world. So, if a bank fails to create a seamless digital experience, it may lose 43% of its customers.

Low Customer Retention

Have you noticed how painful it can be to part with the savings? And it doesn't matter whether you top up the deposit, pay off the loan, transfer the money or perform other banking operations — some sort of regret and woeful loss reaches you all the time. So, when this process is complicated by digital inconvenience or poor client service, the user experience turns into a complete disaster. And that's one of the key reasons why brick-and-mortar banks keep losing customers.

Security Issues

It's no secret that for any bank, thorough round-the-clock security control is a must. And if it communicates with the clients via multiple but separate channels, the scope of control gets significantly extended. As a result, not only does such an approach cause huge extra costs but also makes the entire banking system more vulnerable to hacking attacks and data leakages.

Operational Costs

What do traditional retail banking and next-gen digital banking have in common? Well, they provide the same banking operations. Still, there is a key distinction between them that ensures different levels of customer experience — time & money spent on every operation. Thus, while traditional banks are drowned in dead-alive paperwork and extra compliance costs, fintechs leverage digital capabilities to put each customer at the center of their decisions.

Well, the finance industry is pretty competitive, but don't rush into a panic after reading all this! The good news is that we've already found the solution. Meet omnichannel banking!

Omnichannel Banking in a Nutshell

So, what is omnichannel banking? Simply put, it's an upscale digital solution that allows banks to boost customer satisfaction by uniting multiple communication channels and creating a seamless user experience.

Such an outcome becomes possible through a true omnichannel banking platform with a service-oriented architecture that unifies digital communication channels and traditional channels. As a result, a customer can smoothly switch from a mobile app to a banking manager and solve any issue in no time.

Offline & Digital Channels: What Are They?

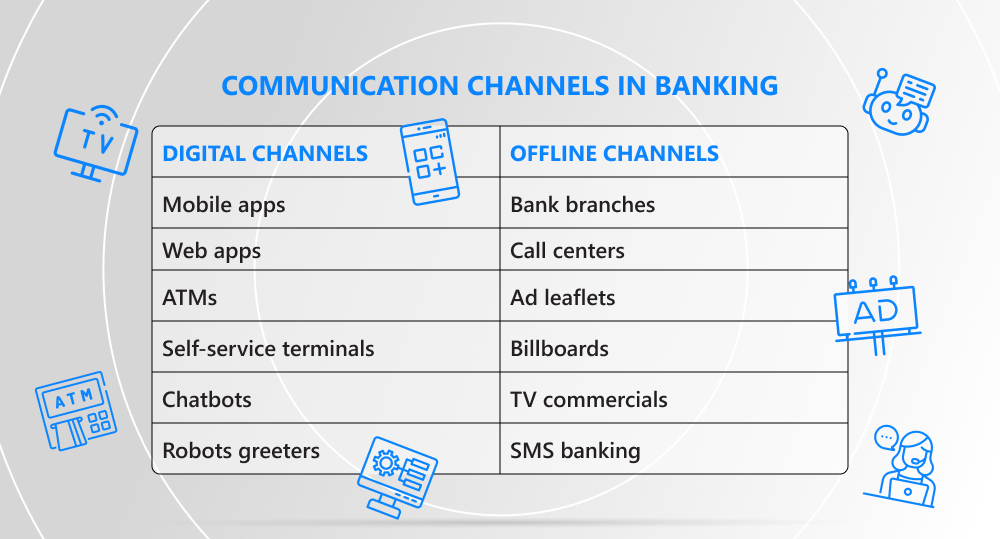

As already mentioned, in omnichannel, a bank interacts with customers through multiple channels. So, what are the major ones?

If bank–customer interactions involve the internet, it means they unfold via digital channels (mobile apps, websites, ATMs, self-service terminals, chatbots, robots greeters, etc.).

And all types of live communication in a branch or via a call center, as well as ad leaflets, billboards, TV commercials, and SMS banking belong to offline channels.

Nowadays, with so many concepts in use, some people confuse omnichannel banking with digital channels only. But since 80% of reluctant technology users still prefer traditional bank branches to digital banking services, especially when it comes to complex issues (mortgages, loans, investments), the omnichannel strategy embraces both kinds of channels.

Also, don't fall into the trap of mixing the omnichannel approach with a multichannel one. Thus, if a bank provides services via several channels, we're witnessing the multichannel strategy in progress. But it only then turns into the omnichannel strategy when customer data from all the channels get unified and managed using one and the same platform.

Omni-channel Experience in Banking: How Exactly Does It Work?

By now, you are surely curious about the specifics of omnichannel customer experience in banking, let's analyze a couple of real-life examples.

Traditional Scenario

David goes to the supermarket twice a week, where he pays for the goods with a credit card. When opening a banking app, he only sees there spam-like ads about a card insurance program. David decides to find some cashback offering (from this very supermarket) and starts chatting with an app bot. After verifying lots of customer data, the bot redirects his request to a bank manager. While talking to the manager, David also has to provide certain information to find out that this drudgery has led to no result.

Omnichannel Approach

On the contrary, Diana buys coffee at a local coffee house every morning. Several weeks later, she finds a catchy bonus program (with this very coffee house on it) in her banking app. She taps on the offer and opens a chatbot to quickly clarify the details. After giving the matter some thought, she decides to link another card to this program and arranges a call with a human bank's representative. As a result, Diana solves the issue without repeated verification in a matter of seconds. Now, she gets every fifth cup of her favorite coffee for free!

Five Reasons to Go Omnichannel

As you see, an omnichannel banking platform ensures superior customer service. But what other benefits may it bring to retail banks?

Increased Brand Awareness

The best way to gain good publicity is to exceed customers' expectations. And since omnichannel banking provides an enhanced user experience, clients recommend the bank to other people more willingly.

Boosted Communication

A truly omnichannel banking experience is one with seamless customer touchpoints happening round-the-clock through various channels. And that's what today's generation is craving.

Optimized Customer Experience

A sophisticated omnichannel banking platform, empowered by advanced analytics and data mining techniques, allows banks to create a smooth hybrid customer journey, and therefore, boost customer retention rates.

Enhanced Security

In omnichannel banking, all transaction data is stored in one place, which simplifies security control and helps prevent fraudulent activities.

Budget-Friendly Solutions

Although an omnichannel platform itself costs a pretty penny, the investment is worth making. Why? By reducing compliance costs and outrunning inflation, this solution will save you even more money in the long run.

Farewell Takeaways

Once you've made up your mind to go omnichannel, all that is left to do is to find a reliable software development partner with a reasonable price-quality ratio. And time-tested ratings & review platforms will simplify your search. Good luck!

Planning to upgrade the services and enhance your omnichannel strategy? Contact our specialists. Qulix is a monster truck among Volvo sedans when it comes to banking software. We know what we are doing and are ready to support you throughout the entire digital transformation journey.

Contacts

Feel free to get in touch with us! Use this contact form for an ASAP response.

Call us at +44 151 528 8015

E-mail us at request@qulix.com