Digital Wallet Solution for All Business Types

Use our digital wallet solution independently or integrate it into an existing platform.

Use our digital wallet solution independently or integrate it into an existing platform.

Our solution encompasses a set of features that make up an eWallet core. We take that core and tailor it to your needs to deliver you a digital wallet system that matches your vision.

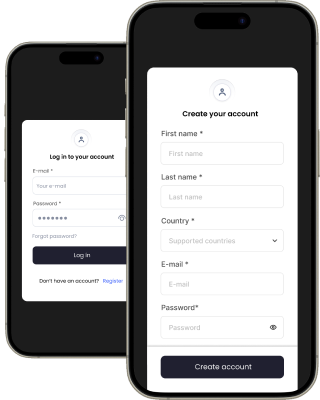

Registration for individual and business clients. Quick integration with a third-party KYC service (like Joomio) followed by a swift sign-in process via social media or biometrics for extra security and fewer fraud risks. If we integrate the product into an existing service, KYC is omitted.

Semi-automatic verification process. Clients need to enter company details, submit documents, and wait for the admin approval (approvals are manual). If we integrate the product into an existing service, this step is omitted.

Account opening. Consumers get to open an e-Wallet in a national currency without visiting banks, which allows them to save time.

Card issuance. We offer to obtain virtual cards and skip the interaction with physical financial institutions. We can integrate Visa, MasterCard, UnionPay, or other payment systems that you have in mind.

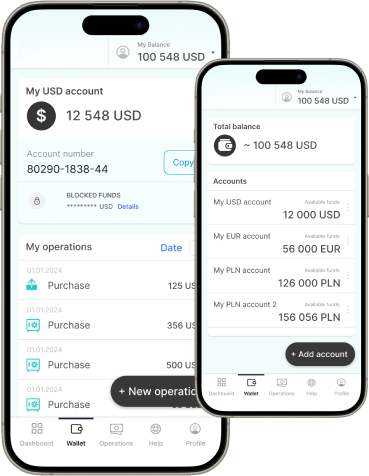

Foreign currency accounts. Our list includes 50+ supported currencies (USD, EUR, GBP, CNY, SGD, KRW, JPY, AED, and others), and their number will continue to grow.

Linking bank accounts. We offer the ability to connect existing accounts to an eWallet for easy account management, i.e., top up and withdrawal operations.

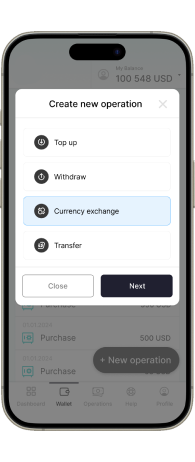

Transfers. Seamless bank-to-bank, wallet-to-bank, and P2P wallet transfers. An international remittance is included.

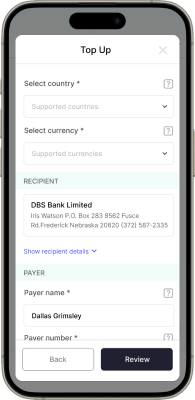

Top up. Users can add balance to the account via any method that works for them best: bank transfers (manual confirmation by an operator required), credit cards, debit cards, etc.

Withdraw. Clients can move funds from an e-Wallet to a bank account (manual processing on the operator's side) or to a debit card via a phone.

Payments. Our eWallet solution makes it possible to pay for a variety of goods and services (subject to local regulation).

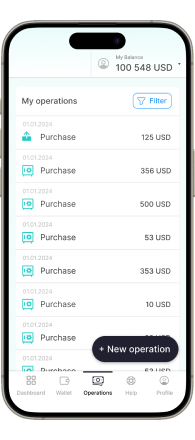

Transaction history. Clients can view details of payments (time, date, amount, etc.) to keep a finger on the pulse of purchases and other spendings.

Digital receipts generation. Users can generate electronic receipts for online payments on the spot.

Contracting. Integrated functionality (e-sign service DocuSign) to sign papers before certain business operations (wallet account opening, top up, etc.). Elevated security and speed are nice bonuses.

QR code generation. To transfer funds with e-Wallets, users can just scan a QR code. They don't need to request banking details of the recipient to send money or receive money at high speed.

Push notifications. Users can get real-time updates on transactions, received and deducted account balances, and more.

A mobile application for both iOS and Android to win over a desired target audience and snatch that competitive edge.

We include an API with necessary documentation to integrate digital wallets into existing products so you don't have to worry about it.

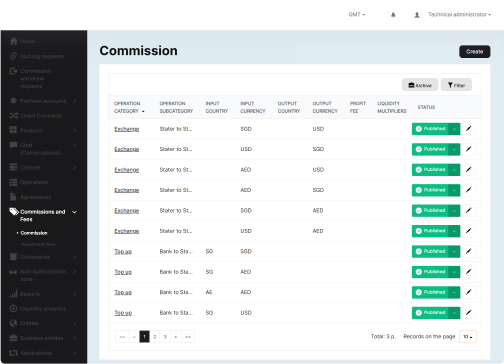

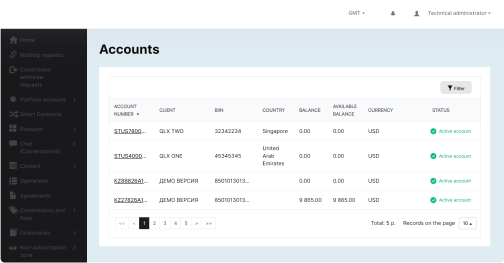

To provide banking services and know what's going on at all times, you need solid admin functionality. Our solution comes with a management portal that helps to control user data, enhance security and safety of operations, and track performance.

It includes such features as:

A classic wallet, but in a digital form. Transfer money, withdraw funds, make payments, etc. Perfect for businesses and individuals looking to handle banking, retail, and eCommerce operations effortlessly.

A safe place to store cryptocurrencies, digital stocks and bonds, as well as a variety of tokens. Works great for businesses and individuals in need of finance management.

An electronic money wallet and a digital asset wallet put together. Allows to execute a wide range of financial operations. A convenient solution for individuals and businesses alike.

A subtype of an electronic wallet. Works best for business clients who want to implement a loyalty program. It might include earning rewards points, cashback, and other perks.

We identify basic eWallet functionality, i.e., a feature set that’s readily available and comprehensible, with clear dependencies and minimal risks. It is called an MVP (a minimum viable product).

Launching a product in the MVP format helps you to significantly reduce the risks of delays, budget increase, etc. An MVP also lets you gather feedback from early users and consider it in the future phases of the development process, thus improving the product.

It takes about 3–4 months to build an eWallet MVP. The scope of work that we do includes:

customization

of the solution

definition of the UI/UX design

concept and its implementation

resolution of deployment

related matters

resolution of matters related

to subsequent support

Contact us if you would like to get a better understanding of the workflow, development time, and subsequent processes. We are here to arrange an online consultation to cover all the details (1 hour).

Pre-study

≈ from 2 to 4 weeks

We determine the client's needs down to the smallest detail. We cover the roadmap of the service development, target audience, specifics of integration with external systems, specifics of the solution’s operation and maintenance.

|

PoC (Proof of Concept)

≈ 4 weeks

Our team deploys the solution in a white label design in a test environment. We perform basic integration with external components and ensure smooth execution of the main scenarios.

|

Beta MVP

≈ from 4 to 8 weeks

Qulix engineers put the finishing touches to the MVP functionality. Designers create a UI/UX design concept and apply it to replace the white label design.

|

Friends & family testing/Go live

≈ 2 weeks

We deploy the solution to the production environment. Our team performs testing on a limited number of users and establishes processes necessary for subsequent support.

|

Continuous development

Qulix team starts the process of continuous development to cover functionality from the project roadmap.

|

Together with the client, we built an investment platform for funding real-world commodity trade deals. The platform offers an extensive functionality that includes a digital wallet. The eWallet, available both for iOS and Android, incorporates a set of features vital for efficient and convenient finance management.

We use a basic set of technologies.

JavaReactPostgreSQLAWS (Amazon)

KubernetesDockerKafka (for certain projects)

Blockchain:

(for digital asset wallets)

SolidityRUSTGetBlockBlockchain scanners

Android:

Kotlin

iOS:

Swift

If necessary, we can use other technologies, like .NET, Go, Node, hybrid mobile frameworks, etc. This will make the work process a little longer, but it won't get fundamentally more complex.

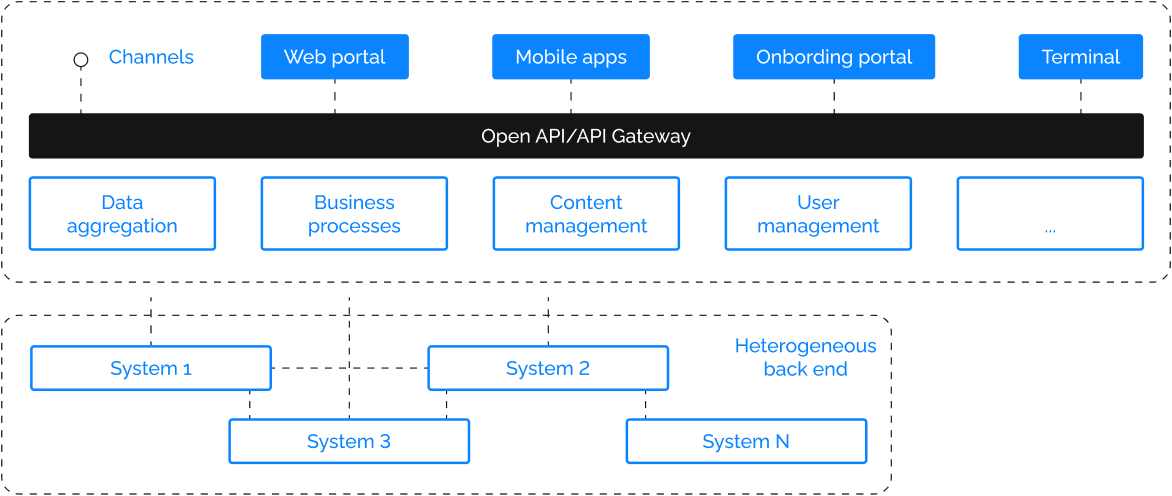

Architecture-wise, an eWallet might be organized this way:

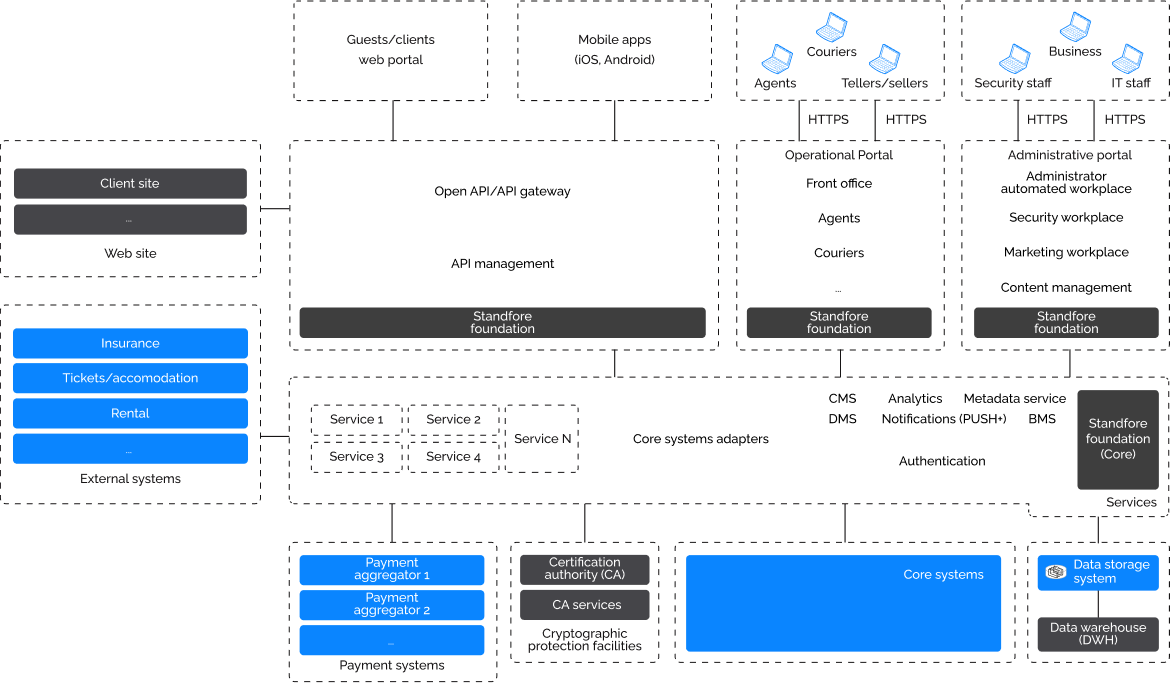

Depending on a business domain, architecture differs. For financial companies like banks, it may look like this:

If you're interested in a detailed discussion of the tech stack, let's meet up for a technical workshop. It's the best way to cover all questions.

We aim to build business partnerships that last. If a project is promising, and we expect it to be long-term, we can pass the solution to the client at a lower cost.

We build a ready-to-use MVP within 3 to 4 months. In addition to the MVP, we provide you with established processes for the future product development.

We have a vast experience with digital assets, investments, cryptocurrencies, cross-border payment processes and remittances, PFM/BFM, and many other things. If you need a partner to develop a project roadmap, we are glad to offer our services.

20+ years in the market, 200+ clients globally, over 80% of projects are banking solutions. We know how to deliver a quality product.

We partnered up with Qulix two years ago to build a finance platform. The team is great to work with. Everybody knows what they're doing, and the communication is always on point.

Our starting point is your needs. What kind of product do you want? What are your plans? Contact us to schedule an hour-long introduction session, where together, we will cover a wide range of questions. Equally, you may send us over documentation that outlines your project. In any case, we sign an NDA right off the bat.

We analyze the information you submit. Our team composes a document that describes our vision for the product implementation, its phases and costs.

The document goes up for discussion.

After negotiations, it’s time to sign an agreement.

The development begins.

Feel free to get in touch with us! Use this contact form for an ASAP response.

Call us at +44 151 528 8015

E-mail us at request@qulix.com